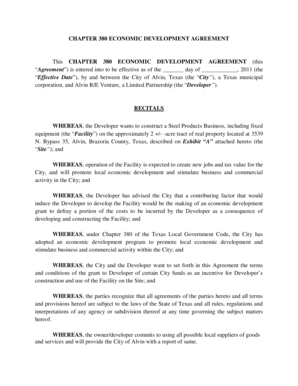

Limited Partnership Agreement Texas

What is limited partnership agreement texas?

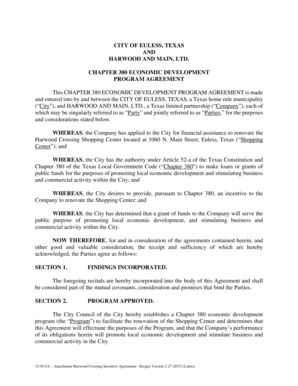

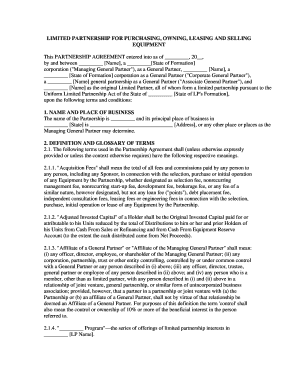

A limited partnership agreement in Texas is a legal document that outlines the rights, responsibilities, and obligations of the partners in a limited partnership. It defines the structure of the partnership, including the contributions of each partner, the distribution of profits and losses, and the decision-making process for important business matters. This agreement is required by the state of Texas to establish and maintain a limited partnership.

What are the types of limited partnership agreement texas?

In Texas, there are two main types of limited partnership agreements: general and limited. 1. General Partnership Agreement: In a general partnership, all partners have equal rights and responsibilities. They share both the profits and losses of the business and have the authority to make decisions on behalf of the partnership. 2. Limited Partnership Agreement: In a limited partnership, there are two types of partners: general partners and limited partners. General partners have the same rights and responsibilities as in a general partnership, while limited partners have limited liability and are not involved in the day-to-day management of the business. They are typically passive investors who contribute capital and share in the profits, but are protected from personal liability for the partnership's debts.

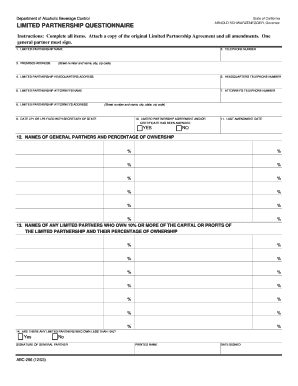

How to complete limited partnership agreement texas

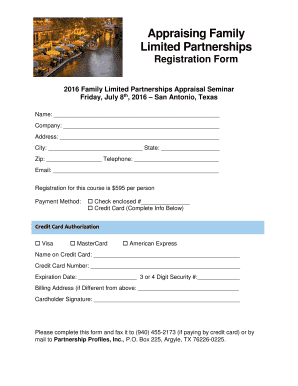

To complete a limited partnership agreement in Texas, follow these steps: 1. Understand the requirements: Familiarize yourself with the rules and regulations governing limited partnerships in Texas. You should understand the rights and obligations of each type of partner, as well as the information that must be included in the agreement. 2. Gather information: Collect all the necessary information, such as the names and addresses of the partners, their contributions, and their rights and responsibilities. Also, include any additional provisions or conditions specific to your partnership. 3. Draft the agreement: Use a template or consult with a legal professional to draft the agreement. Make sure to include all the required information and customize it to fit the needs of your partnership. 4. Review and revise: Carefully review the agreement to ensure it accurately reflects the intentions of all partners. Make any necessary revisions or clarifications. 5. Sign and notarize: Once all partners are satisfied with the agreement, sign it in the presence of a notary public. This will make the agreement legally binding. Remember, if you need assistance in creating or editing your limited partnership agreement, you can rely on pdfFiller. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.