What is limited partnership agreement real estate?

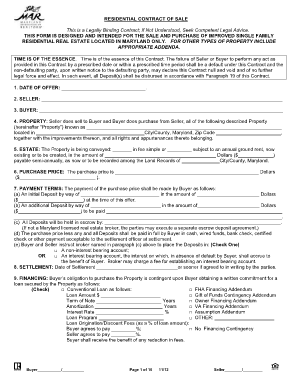

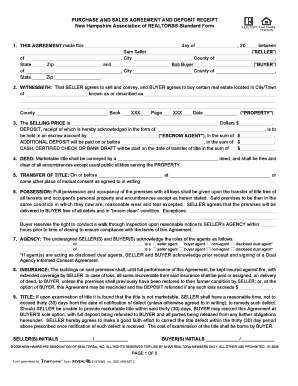

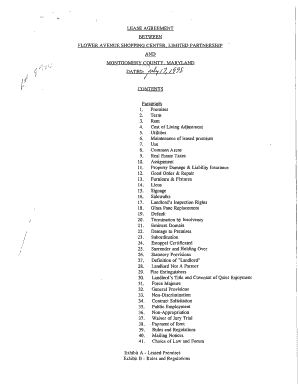

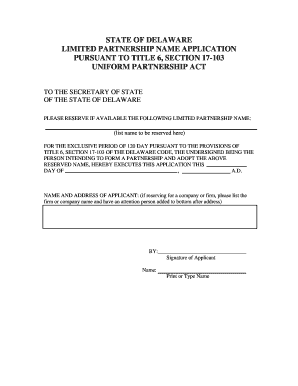

Limited partnership agreement real estate refers to a legally binding document that outlines the terms and conditions of a partnership between two or more parties in the real estate industry. This agreement defines the rights, obligations, and responsibilities of each partner, as well as the distribution of profits and losses. It serves as a framework for the partnership's operations, decision-making processes, and dispute resolution mechanisms.

What are the types of limited partnership agreement real estate?

There are several types of limited partnership agreement real estate, including:

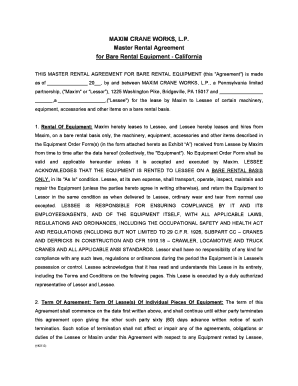

General Partner: This type of partnership agreement involves a general partner who assumes unlimited liability for the partnership's debts and obligations.

Limited Partner: In this type, the limited partner contributes capital to the partnership but has limited liability and is not involved in the day-to-day management of the business.

Limited Liability Partnership (LLP): This form of partnership limits the liability of all partners, protecting them from personal financial loss beyond their investments.

Limited Liability Limited Partnership (LLLP): It combines the features of a limited liability partnership and a limited partnership, offering limited liability to all partners.

Real Estate Investment Trust (REIT): While not a partnership agreement, REITs allow investors to pool their resources to invest in various real estate ventures.

How to complete limited partnership agreement real estate

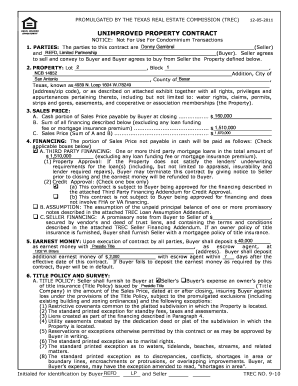

To complete a limited partnership agreement real estate, follow these steps:

01

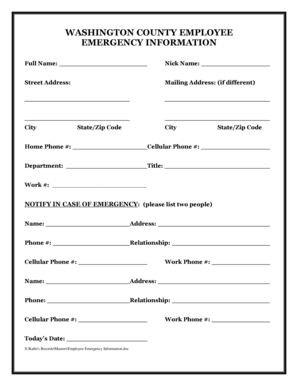

Identify the partners: Clearly list the names and contact information of all partners involved in the agreement.

02

Define partnership details: Specify the purpose of the partnership, duration, and how profits and losses will be divided.

03

Outline partner contributions: Explain each partner's capital contributions, including cash, property, or other assets.

04

Establish partner roles and responsibilities: Define the responsibilities and decision-making authority of each partner.

05

Determine dispute resolution methods: Include provisions for resolving conflicts or disputes between partners.

06

Seek legal advice: Consult with an attorney experienced in real estate law to ensure the agreement complies with local regulations and protects all parties involved.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.