Limited Partnership Agreement - Page 2

What is Limited Partnership Agreement?

A Limited Partnership Agreement is a legal document that outlines the rights and responsibilities of the partners in a limited partnership. It defines the terms of the partnership, including the allocation of profits and losses, management responsibilities, and the process for admitting or removing partners.

What are the types of Limited Partnership Agreement?

There are two main types of Limited Partnership Agreement:

General Partners - These partners have unlimited liability and are responsible for managing the partnership.

Limited Partners - These partners have limited liability and are only liable for the amount they have invested in the partnership.

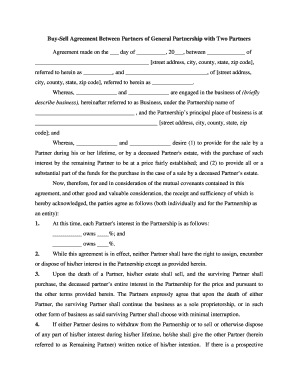

How to complete Limited Partnership Agreement?

To complete a Limited Partnership Agreement, follow these steps:

01

Gather the necessary information about the partners, including their names, addresses, and capital contributions.

02

Define the terms of the partnership, including the duration, profit-sharing arrangements, and decision-making processes.

03

Outline the roles and responsibilities of each partner, including any limitations on their authority.

04

Include any additional clauses or provisions that are relevant to the specific partnership.

05

Review the agreement with all partners and make any necessary revisions.

06

Have each partner sign and date the agreement to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Limited Partnership Agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What makes a partnership agreement legal?

A legally binding partnership, however, requires that each partner is assigned specific roles and responsibilities, financial expectations, and future planning expectations for the business. The partnership should also have an agreement as to handling the exit of one of the business partners.

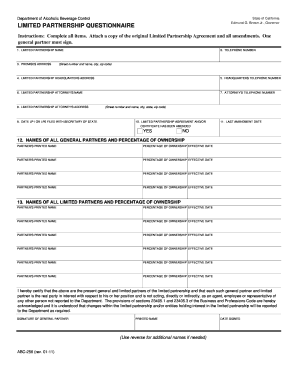

How do I form a limited partnership?

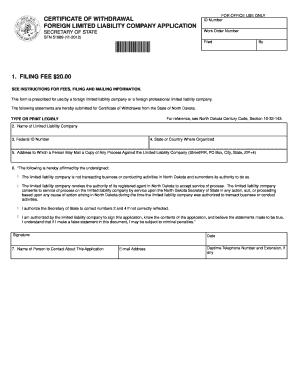

To form a limited partnership, the partners must enter into a partnership agreement and file a certificate of formation with the secretary of state. In a limited partnership, there will be one or more general partners and one or more limited partners.

How do you set up a limited partnership?

To form a limited partnership, you have to register in your state, pay a filing fee and create a limited partnership agreement, which defines how much ownership each limited partner has in your company, and other terms of the partnership.

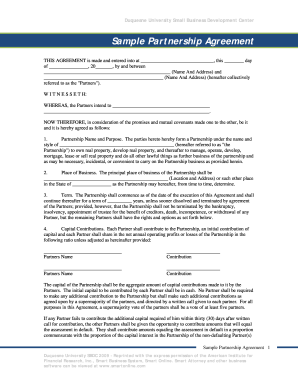

What is included in a limited partnership agreement?

The Limited Partnership Agreement identifies what individual or other entity serves as the general partner. It also lists the ownership interests, profit percentage interest and any special rights of the general partner and limited partners.

How many people do you need to form a limited partnership?

A limited partnership must have at least one general partner and one limited partner. One person may not form a limited partnership by being designated as the only limited and general partner.

How do you write a simple partnership agreement?

How do I create a Partnership Agreement? Specify the type of business you're running. State your place of business. Provide partnership details. State the partnership's duration. Provide each partner's details. State each partner's capital contributions. Outline the admission of new partners.

Related templates