P45 Form Download

What is P45 Form Download?

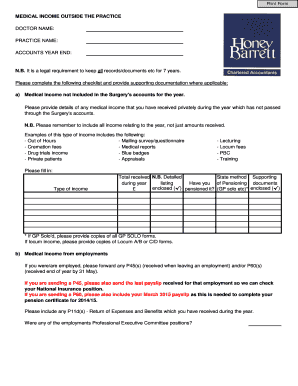

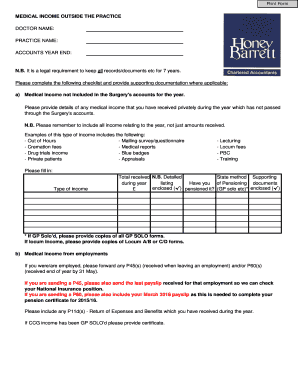

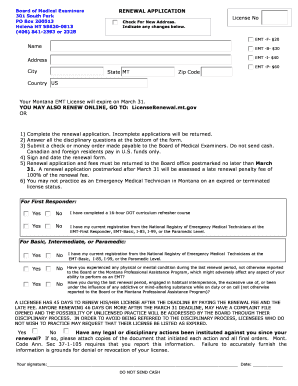

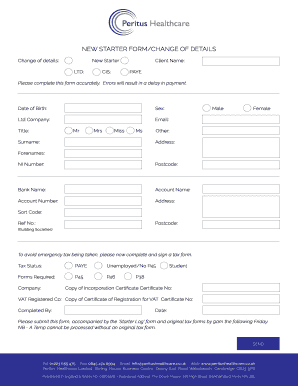

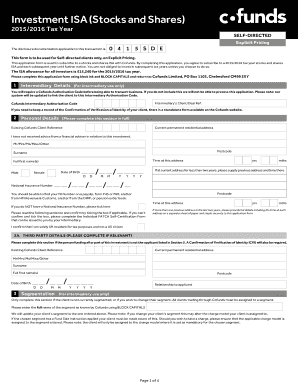

The P45 Form Download is a document used in the United Kingdom that contains important information about an employee's income and tax deductions. It is provided by employers when an employee leaves their job. The P45 Form includes details such as the employee's cumulative earnings, tax code, and the amount of tax that has been paid.

What are the types of P45 Form Download?

There are three types of P45 forms that can be downloaded:

How to complete P45 Form Download

Completing the P45 Form Download is a straightforward process. Here are the steps you need to follow:

With pdfFiller, completing the P45 Form Download is even easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.