Savings Calculator - Page 2

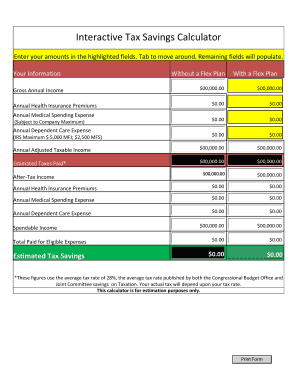

What is Savings Calculator?

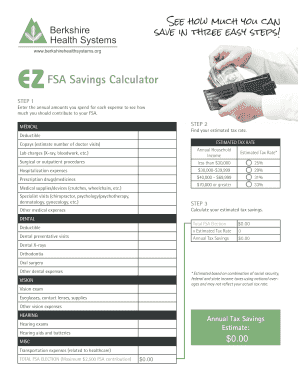

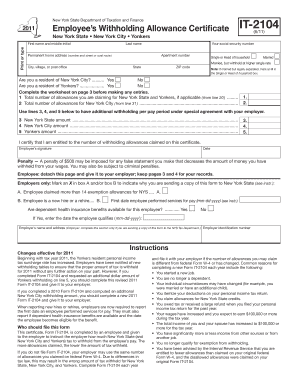

A Savings Calculator is a helpful online tool that allows users to calculate how much money they can save over a specified period of time. By inputting certain variables such as initial investment, interest rate, and time period, the calculator provides users with an estimate of their potential savings.

What are the types of Savings Calculator?

There are several types of Savings Calculators available to cater to different saving goals and financial situations. Some common types include:

Retirement Savings Calculator

College Savings Calculator

Mortgage Savings Calculator

Debt Payoff Savings Calculator

Emergency Fund Savings Calculator

How to complete Savings Calculator

Completing a Savings Calculator is a straightforward process. Here are the steps to follow:

01

Enter the initial investment amount you have or plan to make.

02

Input the interest rate applicable to your savings.

03

Specify the time period for which you want to calculate your savings.

04

Click on the Calculate button to obtain the estimated savings amount.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Savings Calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a savings spreadsheet?

1. Set Up the Backbone of Your Spreadsheet Your Target – the amount you want to save. Your opening balance – how much you've already saved. Add adjustments – (optional) in case you get extra money to add or want to swap some money between your savings goals. The months of the year. Total savings for this year.

How do you calculate percent savings on a calculator?

How do I calculate discount in percentages? Subtract the final price from the original price. Divide this number by the original price. Finally, multiply the result by 100. You've obtained a discount in percentages. How awesome!

How much interest does $10000 earn in a year?

Currently, money market funds pay between 0.85% and 1.05% in interest. With that, you can earn between $85 to $105 in interest on $10,000 each year.

How do I calculate net savings in Excel?

How to Calculate Percentage Savings in Microsoft Excel Enter the normal price for one or more items in one column. Change the price cells to the Currency format. The Autosum formula adds all of the prices together. The formula =SUM(B6)*. The formula =SUM(B6-B7) subtracts the discount from the regular price.

How do you calculate saving goals?

If you're looking for help in becoming a better saver, here are some tips on how to set savings goals. Choose a specific savings goal. First, define your goal. Set a savings deadline. Create a different account for each goal. Track your goals. Break your goals down into smaller chunks. Automate your goals.

What is the formula to calculate savings in Excel?

=PMT(1.5%/12,3*12,0,8500) to save $8,500 in three years would require a savings of $230.99 each month for three years. The rate argument is 1.5% divided by 12, the number of months in a year. The NPER argument is 3*12 for twelve monthly payments over three years.

Related templates