Itemize Phone Contract Gratuito

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

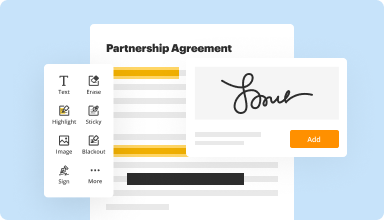

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

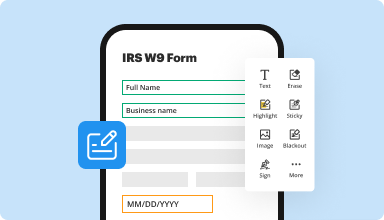

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

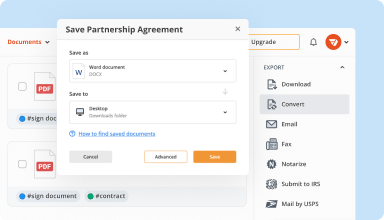

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

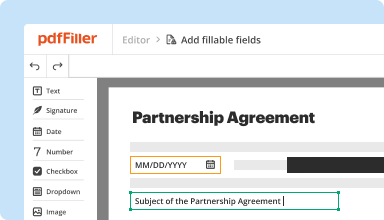

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

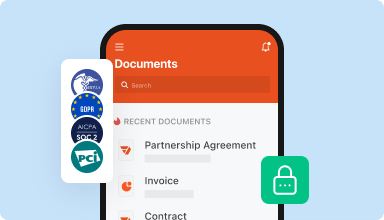

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

The best service ever! As a chiropractor, I am able to fill out my exam and soap notes with pdffiller then save them in the encrypted files for Hipaa compliance. My office is on its way to paperless as we speak. I love this service. Highly recommend it to all.

2014-10-17

Would like to have available stand-by the form I am working on. Have to use the same for different companies and each time I start a new one, have to go back and search for it.

2015-02-25

Very user friendly site. I did lose my first document, since I didn't select the 'DONE' box first. Maybe just a little pop up message on how important that step is would be helpful.

2015-06-21

First time using PDFfiller. When I copy and past to make a document I would like to change the font color from black and blue or another color. Other than that, like the service

2017-05-31

I really like PDFfiller and it really easy to use. My only suggestion would be that you offer some way to delete or erase Fillable Names etc. that are saved if we choose. (i.e. Wrong spellings or no longer needed information.)

2018-06-05

I am satisfied with the PDF filler. I will not need it often enough to pay a monthly fee. We will only use once or twice a year at the very most for personal use.

2019-07-29

Though you have a great product, I no longer needed it.I had thought I had cancelled before the free trial was up, but, apparently, I had not. So, I asked for help to cancel and get a refund. It was done within a half an hour! Great Service!

2022-06-26

What do you like best?

Not only is the actual program extremely easy to use, but when i did happen to need support, the guy, Ray, I was connected to was happy to fulfill my every request and in less than 5 minutes had me back to my project. And my issue was requesting my already processed payment for a whole year subscription be returned and only run for a month. I was prepared to argue and be given every excuse out there just to be let go with a bad taste in my mouth and not helped. Boy was I wrong! Ray was super helpful and more than happy to process my request. I was pleasantly surprised. You just don't find customer service reps like this anymore and it's a shame. I was extremely pleased!!!

What do you dislike?

I don't like that in the Google search it claims to be a free PDF editor but when you get finished with whatever you are working on, mine was 48 pages, before you can save or print the document you are asked to purchase a 1-year subscription.

Recommendations to others considering the product:

The program is easy to use, affordable, and customer support is top-notch. What more could you ask for??

What problems are you solving with the product? What benefits have you realized?

I used pdfFiller to edit divorce papers I downloaded from the court clerk's website in another city in my state. PdfFiller allowed me to be able to draw up my own divorce papers instead of paying an attorney more than $500 to do it for me.

Customer Service Representative, RAY, is a HUGE benefit I have realized.

2022-04-16

I looked at some pdf that were not…

I looked at some pdf that were not editable until I found PDFiller. Great experience and so useful in my tax business.

2025-03-11

Itemize Phone Contract Feature

The Itemize Phone Contract feature offers a clear and concise tool for managing your phone contracts. It helps you understand your obligations, costs, and the benefits of your current plan, making it easier for you to make informed decisions.

Key Features

Detailed breakdown of contract terms and conditions

Clear visibility of monthly payments and total costs

Reminders for contract renewal dates

Customization options for tracking multiple contracts

User-friendly interface for easy navigation

Potential Use Cases and Benefits

Effectively track your phone contract commitments

Plan your budget by understanding costs upfront

Receive alerts to avoid contract overages

Easily compare and switch plans if necessary

Stay organized with multiple contracts in one place

By using the Itemize Phone Contract feature, you can take control of your phone agreements. It simplifies your experience, reduces confusion, and ultimately helps you save money. You no longer need to worry about hidden fees or unexpected payments. This tool empowers you to stay informed and make choices that best suit your needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Is cell phone deductible business expense?

Your cellphone as a small business deduction If you're self-employed, and you use your cellphone for business, you can claim the business use of your phone as a tax deduction. If 30 percent of your time on the phone is spent on business, you could legitimately deduct 30 percent of your phone bill.

Can my business pay for my cell phone?

If you use your own mobile device for business purposes whether you're an employee or self-employed you can claim a cellphone business expense based on the portion of the time that the device is used for business. ... The best way to establish this percentage is by using your phone bill if it itemizes your calls.

What business expenses are deductible in 2019?

You can deduct business-related travel expenses, office supplies and equipment, and health insurance premiums from your self-employment income, just to name a few potential deductions.

Can my LLC pay for my cell phone?

Just pay your cell phone bill as you normally would and write off 60-75% of it off as a business expense under the LLC.

Can my small business pay for my cell phone?

If you're self-employed, and you use your cellphone for business, you can claim the business use of your phone as a tax deduction. ... In Entrepreneur magazine, writer Kristin Millhauser recommends getting an itemized phone bill, so you can measure your business and personal use and prove your deduction to the IRS.

Can I use my personal phone for business?

If you need a cell phone for work, your employer can insist that you use your own. ... If your employer swings the other way and requires you use your personal phone, the company may reimburse you. If they don't cover your expenses, you may get a tax write-off out of it.

Can I deduct personal cell phone for business?

If your new cell phone acts as both your business and personal phone, you are only allowed to deduct the portion used for business from your taxable income. It's important for you to hang on to your itemized phone bill and receipts to ensure that you're deducting the right amounts and to keep records of your deduction.

Is a cell phone purchase a business expense?

Your smartphone is on the Internal Revenue Service's list of equipment you may write off as a business expense. As long as you use your smartphone mostly for business purposes, the IRS lets you deduct its purchase price and service fees.

What type of business expense is a cell phone?

No. Cell phone expenses are not considered home office expenses. Rather, your cell phone expenses are in their own category for deductions. Whether you are an employee or self- employed will make a difference in where you enter this expense.

Are cell phones a business expense?

A Phone Can Be a Working Condition The nonbusiness personal use of the cellphone is not deductible as a business expense of the company. If you require employees to use mobile phones for business purposes, the employee's personal use is treated for tax purposes as a DE minimum fringe benefit.

#1 usability according to G2

Try the PDF solution that respects your time.