Prompt Elect Invoice Gratuito

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

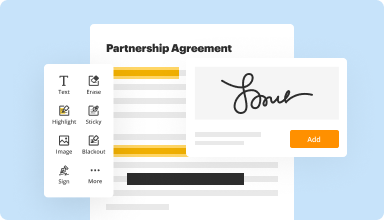

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

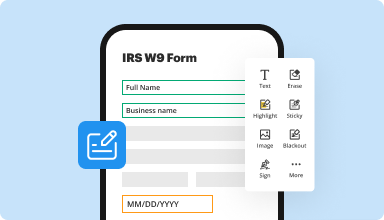

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

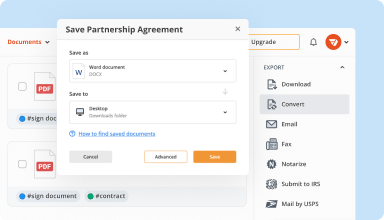

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

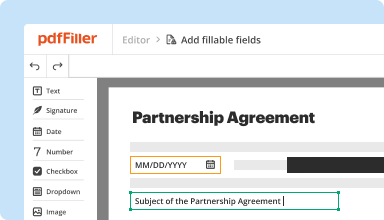

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

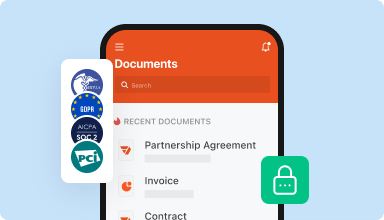

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Saving me so much paper and I'm feeling really positive about my environmental impact. We are in the process submitting our B Corp assessment and this product has highlighted that with some thought you can make small differences

2017-10-06

I found this program very user friendly. I am grateful for being able to do my tax forms and get all the information I need on this site. I would highly recommend it to anyone trying to make since of tax forms.

2018-02-16

I purchased the product. It was because I needed to complete a form for an important Employment opportunity. After I spent 4 hours on the form. I was ready to print then was asked to make payment. after I subscribed; I then tried to print the form. Long story short; I could not print the document and then when I accessed it later to try and correct the issue, the information I had put in was all over the place. (in the wrong places). I have then canceled my subscription and have just wasted my $72 US Dollars. I know I will not be refunded, even if I was only Subscribed to the product for less then 6 hours or so. I would never recommend this product to anyone ever.

I immediately got a response and refund... which tells me that this company is serious about its reputation and customers service. Thank you so much for the upright service. Because of that I will recommend this to anyone and everyone

2018-03-22

Happy User

we have accidentally deleted some forms and we couldn't find it, but our overall experience is great

easy to create a fillable forms and let our clients to fill

need to pay upgrade to get certain function, like just directly download the filled form from my clients

2019-03-19

Since finding PDF Filler, I have been able to gain advantage through the utilization of the plethora of forms that I needed in order to remedy some problems.

2024-09-04

Hands down the best pdf editor period. I was able to white out and edit my document. No other application has given me this ability and it saved me so much time.

2022-12-18

PDF filler is a game changer in how I…

PDF filler is a game changer in how I want to show up in the workplace as a professional. The website is helpful, easy to navigate, and very affordable. There isn't a document type that I need that I can't just type in search and locate. Thank you!

2022-09-02

I needed a straightforward way to file…

I needed a straightforward way to file an extra tax form, and PDF Filler helped me out! Much easier than finding the form on the IRS website (somehow impossible?) and hoping for the best.

2021-10-12

I am very excited to use this product. I was able to troubleshoot much on my own. My only struggle was in saving final product and bringing back up to update.

2020-08-20

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the prompt payment clause?

The Prompt Payment rule makes sure that valid and proper invoices submitted by vendors are paid on time by federal agencies. If a vendor submits a proper and valid invoice, the agency must pay it on time. If not, the payment is late. In most cases when an agency pays a vendor late, it must pay interest.

What does prompt payment mean?

From Wikipedia, the free encyclopedia. Prompt payment is a commercial discipline which requires businesses to: agree fair and reasonable payment terms with their suppliers. Ensure suppliers' invoices are approved and paid within agreed terms. Encourage adoption of the same practices throughout their supply chain.

What is the purpose of prompt payment laws?

PROMPT PAYMENT ACT. A law enacted in order to ensure that companies transacting business with the Government are paid in a timely manner. With certain exceptions, the Act requires that the Government make payment within 30 days from the date of submission of a properly prepared invoice by a contractor.

What is the Prompt Payment Code?

The Prompt Payment Code (PPC) was created by the UK government in 2008 in response to a call from businesses for a change in payment culture. It established a set of principles for businesses when dealing with and paying their suppliers that commit them to paying on time and fairly.

What is prompt payment date?

Prompt Pay Due Dates. The term Prompt Pay refers to the timely payment of goods and services. Proper due dating means that you compare the date you received the goods or service AND the date you received the invoice.

What is the prompt payment interest rate?

The Treasury Department has announced that the Prompt Payment Act (PPA) interest rate increased to 3.625% per annum for the first half of 2019 i.e., January 1, 2019, through June 30, 2019.

What is the Texas Prompt Payment Act?

The Texas Prompt Payment Act does allow the withholding of payments on public works projects in particular circumstances. The entity, vendors (prime contractors), and subs may withhold payments if there is a bona fide dispute about the goods delivered or services performed.

How often can a contractor request progress payments?

The Government will make progress payments to the Contractor when requested as work progresses, but not more frequently than monthly, in amounts of $2,500 or more approved by the Contracting Officer, under the following conditions: (a) Computation of amounts.

#1 usability according to G2

Try the PDF solution that respects your time.