Ultimo aggiornamento il

Aug 16, 2021

Revise Wage Document Gratuito

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

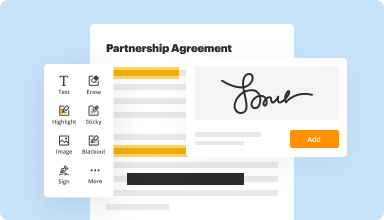

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

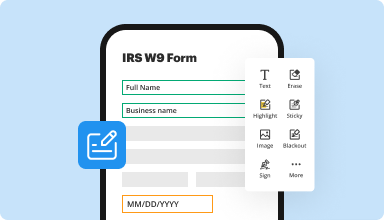

Fill out & sign PDF forms

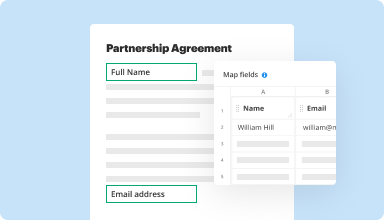

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

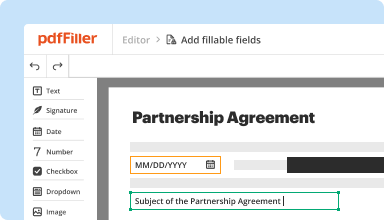

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

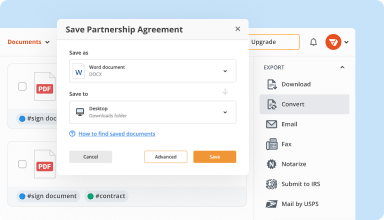

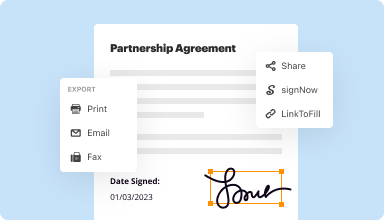

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

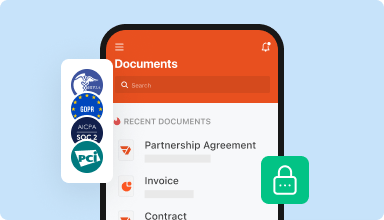

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

This product is wonderful. I use it to complete certain forms for real estate transactions that have blanks which must be filled in. This product allows me to fill in the blanks and then print a nicely completed product. Before using this product I wrote in my hand the information for the blanks which was made a less than neat finished product.

2015-12-18

I used PDF filler to complete a URLA form because the one I was sent by a loan officer was so small I couldn't fit the information in it. PDFfiller made it very easy for me to see and complete the form. I feel that this service would be good for a small business owner because there are many documents available as well as documents that explain the documents you are completing.

2016-09-12

this program has made my life so much easier - I use it to fill in PDF forms for my doctor visits as well as for business - keeps everything simple and in one place. Very user friendly.

2019-04-26

It's really convenient, I've been using it to fill out paper applications since I don't like filling them out since I have dysgraphia. I have some slight issues though, like I had one application where the check box would automatically do a cross and if I want to do a checkmark I have to drag it, which I also have issues with it aligning correctly. alignment isn't too bad, but it's slightly off. Otherwise I love using this site. :D

2019-10-29

What do you like best?

I enjoy PDF Filler because it is not as expensive as Adobe Pro, and it allows me to quickly edit, sign, and return any PDF document I would normally need to print out, and scan back to myself.

What do you dislike?

One dislike I have is the fact I need to download everything. It would be really helpful if everything would be automatically saved on something like a onedrive (cloud storage), where it would be automatically saved. This way, I can have a local folder on my computer without needing to go into the webpage and click download

What problems is the product solving and how is that benefiting you?

I no longer need to waste paper to download a form, and fill it out. Normally I would need to do this, then scan it back to myself. now I can upload, edit, and sign the form which saves a lot of time.

2022-11-07

Trustworthy

I urgently needed something to edit pdf and nothing else was working on library pc. I gave it a try, doesn't have all features I needed so I aksed for cancelling subscription which was DONE INSTANTLY! Very good support. Thank you, good luck for your bussines.

2022-03-18

Being a small business

Being a small business, it was so delightful to be able to find and fill 1099s for my employees and not have to pay money up front. Thank you pdfFiller!

2022-02-01

What do you like best?

It is much easier to use than Adobe Acrobat. Much more intuitive functions and file management. It has saved me a ton of time with the cloud storage of documents. I have used effectively for construction related documents.

What do you dislike?

Very rarely I have needed to use another platform because some municipalities require it but 98% of what I need to do is supported.

What problems are you solving with the product? What benefits have you realized?

Remote completion of forms and extracting text from PDF documents mostly.

2021-02-16

What do you like best?

I enjoy the ability to amend docs without having to print.

What do you dislike?

There are many buttons to navigate, perhaps a simpler layout

What problems are you solving with the product? What benefits have you realized?

I complete many Acord insurance applications on PDF. Benefits are submitting clean looking professional apps.

2021-02-16

Revise Wage Document Feature

The Revise Wage Document feature helps you manage and update employee wage records effortlessly. Whether you need to adjust salaries, correct errors, or implement new wage policies, this tool simplifies the process. You will find it designed to meet a variety of needs, ensuring your team's compensation records are accurate and up-to-date.

Key Features

User-friendly interface for easy modifications

Real-time updates for immediate changes

Comprehensive audit trails for accountability

Integration with payroll systems for seamless operations

Customizable templates for various wage structures

Potential Use Cases and Benefits

Adjusting wages after performance reviews

Correcting discrepancies in employee pay records

Implementing new pay scales for updated company policies

Facilitating compliance with labor regulations

Enhancing transparency and trust within your organization

By addressing these common challenges, the Revise Wage Document feature helps you maintain accurate and reliable wage records, ultimately saving you time and reducing stress. With this feature, you can ensure that your employees receive fair and timely compensation while streamlining your wage management processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is a wage employer correction sheet?

What does this letter mean? This letter lists each of the employers for which you worked and the corresponding base period wages. The correction sheet provides a method for you to make any necessary corrections to wages or employers listed.

What are UI wages?

The UI program provides temporary payments to people who are unemployed through no fault of their own. UI is paid by the employer. Tax-rated employers pay a percentage on the first $7,000 in wages paid to each employee in a calendar year. The UI rate schedule and amount of taxable wages are determined annually.

What is UI gross wages?

The level of unemployment benefits a worker is eligible to receive depends largely on that employee's gross wages during the eligibility period. For a worker, a gross wage is simply everything earned during the period before the removal of taxes or any special payments.

What are UI taxes?

Unemployment Insurance (UI) Tax The UI program provides temporary payments to people who are unemployed through no fault of their own. UI is paid by the employer. Tax-rated employers pay a percentage on the first $7,000 in wages paid to each employee in a calendar year.

How do they determine how much you get for unemployment?

The California Employment Development Department (EDD) determines your weekly benefit amount by dividing your earnings for the highest paid quarter of the base period by 26, up to a maximum of $450 per week. Benefits are available for up to 26 weeks.

What is a UI employer type?

Unemployment Insurance (UI) is a federal-state program jointly financed through Federal and state employer payroll taxes (federal/state UI tax). However, some state laws differ from the Federal law and employers should contact their state workforce agencies to learn the exact requirements. Click here for state links.

What are UI gross wages?

The level of unemployment benefits a worker is eligible to receive depends largely on that employee's gross wages during the eligibility period. For a worker, a gross wage is simply everything earned during the period before the removal of taxes or any special payments.

What is my gross wage?

Gross wages are the total amount you pay an employee before you withhold taxes and other deductions. Because of payroll withholding, an employee's take-home pay can be significantly less than their gross wages. You can calculate an employee's gross pay for different periods of time.

#1 usability according to G2

Try the PDF solution that respects your time.