U-Sign-It Gross Information Gratuito

Use pdfFiller instead of U-Sign-It to fill out forms and edit PDF documents online. Get a comprehensive PDF toolkit at the most competitive price.

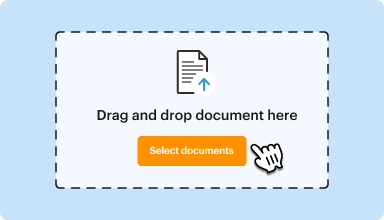

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Ultimo aggiornamento il

Aug 16, 2021

Discover the simplicity of processing PDFs online

Upload your document in seconds

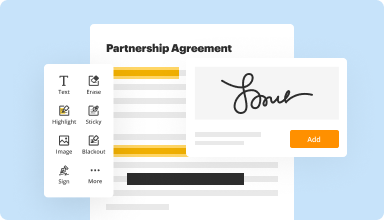

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

Fill out & sign PDF forms

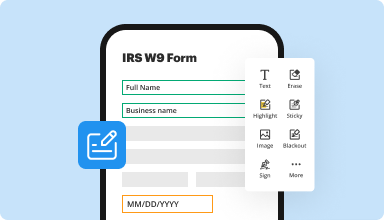

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

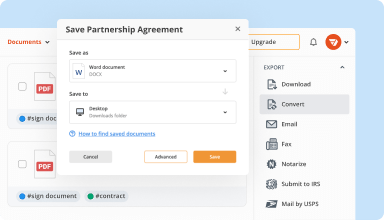

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

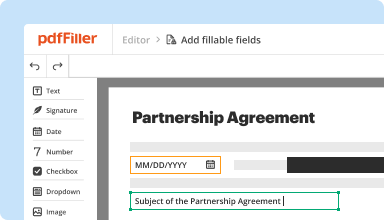

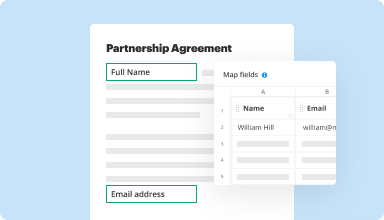

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

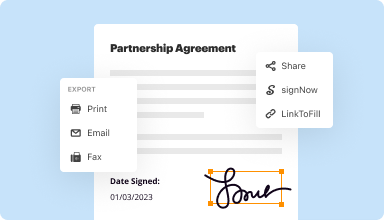

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

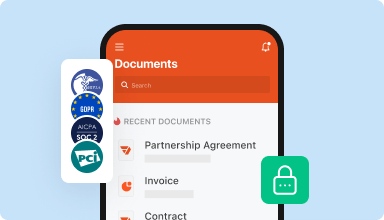

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I stumbled onto this software product because I needed to redo a 2012 - 1099 form. Since then, I've used it for other forms and I LOVE THE SOFTWARE!! I can't tell enough other people how great it is.

2014-08-05

Great Site to find any form you may need! As a Restaurant and Bar owner, it's really convenient when you need a specific form quick, they have everything I have ever looked for! Quick and easy! 5 Stars and 2 thumbs up!!!

2015-10-13

PDFfiller have made life very easy for me to do my Taxes, Printing, Faxing, PDFfiller made it so easy to send out very important paperwork. Everything is on this want site. Thank You.

2019-01-28

This system is amazing, but I have trouble with the 40 per month fee, but I will notify my supervisors at the business, it would be a great investment for the company as a whole.

2020-03-16

Pricing is very good

Pricing is very good. Free trial helped a lot to discover vital features. After trial I have decided to purchase a subscription. Esign, editing, and organizing are working perfectly

2019-05-24

Excellent Software and a great price

Very good and have used it for years.

PDF filler works so well and make it so easy to fill out forms online. It works and the price is very reasonable. I use this for all of my documents as it saves me time.

I can't think of a negative with the software, it always works and has a range of features which are constantly getting better.

2018-10-20

Well

Well, this is my first experience and it was very well, although I will be sure of this assestment until I receibe the opinion of my coleges since they will read the edited pdf.

What I think that PdfFiller is doing well? Well let me have another edition experience and I will be on the condition to answer this question.

The only thing that I didn't like, was that I select the option to pay 15 dlls and the charge to my credit card was almost twice.

2023-10-11

pdfFiller has wonderful support. You can email them or use a chat feature. From the chat feature, I was able to do a remote session through zoom to get my issues resolved quickly. Through email they always respond within 20 minutes. Great customer service!

2022-05-26

It really helps being Paper Less. I don't need to travel to me nearest FedEx to Print job applications and drop them off at the actual location. I can just download the PDF and fill it out to send right back .

2020-07-16

U-Sign-It Gross Information Feature

Discover the U-Sign-It Gross Information feature, designed to streamline how you handle important data. This feature empowers users to manage and utilize gross information effectively across different scenarios. Whether you are in finance, logistics, or any data-driven sector, this tool offers the simplicity and efficiency you need.

Key Features

Intuitive data input and management system

Real-time updates to ensure accuracy

Comprehensive reporting tools for better insights

User-friendly interface that requires no special training

Secure data handling that protects sensitive information

Potential Use Cases and Benefits

Enhance decision-making with accurate data reporting

Reduce operational errors through streamlined processes

Improve team collaboration with easy data access

Simplify compliance and audit preparations with clear records

Save time and resources by automating data handling tasks

U-Sign-It Gross Information feature solves your data management problems by providing a reliable platform for handling complex information. This tool minimizes the risk of errors and allows you to focus on what matters most—growing your business. With its user-friendly design and powerful features, you can manage your data confidently and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the formula to calculate gross pay?

Gross pay for salaried employees is calculated by dividing the total annual pay for that employee by the number of pay periods in a year. For example, if a salaried employee's annual pay is $30,000, and he or she is paid twice a month, the gross pay for each of the 24 pay periods is $1250.

What does it mean to gross up?

To increase a net amount to include deductions, such as taxes, that would be incurred by the receiver. This term is most frequently used in terms of salary; an employee can receive their salary grossed up, which means that they would receive the full salary promised to them, without deductions for tax.

What is grossing up and why it should be done?

Key Takeaways. A gross-up is an additional amount of money added to a payment to cover the income taxes the recipient will owe on the payment. Grossing up is most often done for one-time payments, such as reimbursements for relocation expenses or bonuses. Grossing up can also be used to game executive compensation.

What do you mean by grossing up?

To increase a net amount to include deductions, such as taxes, that would be incurred by the receiver. This term is most frequently used in terms of salary; an employee can receive their salary grossed up, which means that they would receive the full salary promised to them, without deductions for tax.

How does a gross up work?

A gross up is when you increase the gross amount of a payment to account for the taxes you must withhold from the payment. Let's say you promise an employee a specific pay amount. You will issue gross wages for more than the promised amount. The gross up basically reimburses the worker for the withheld taxes.

How do I calculate tax gross up?

Add up all federal, state, and local tax rates.

Subtract the total tax rates from the number 1. 1 tax = net percent.

Divide the net payment by the net percent. Net payment / net percent = gross payment.

Check your answer by calculating gross payment to net payment.

Why would an employer calculate a gross up amount for an employee?

A tax gross up is when the employer offers an employee the gross amount that will be owed in taxes. This additional income helps to relieve the employee of the tax liability associated with relocation expenses.

How do you calculate gross up?

Add up all federal, state, and local tax rates.

Subtract the total tax rates from the number 1. 1 tax = net percent.

Divide the net payment by the net percent. Net payment / net percent = gross payment.

Check your answer by calculating gross payment to net payment.

How to U-Sign-It Gross Information - video instructions

Watch the video guide to learn more about pdfFiller's online Signature feature

#1 usability according to G2

Try the PDF solution that respects your time.