Balance Sheet In Excel

What is Balance Sheet In Excel?

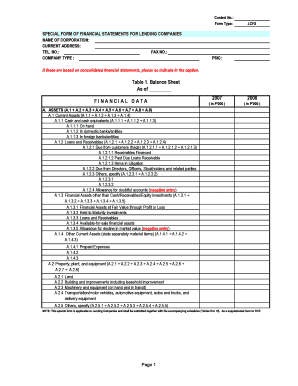

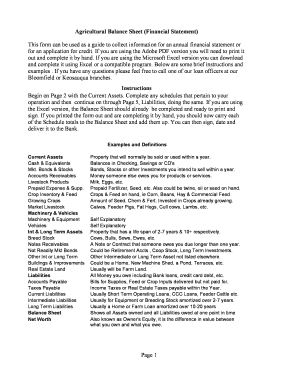

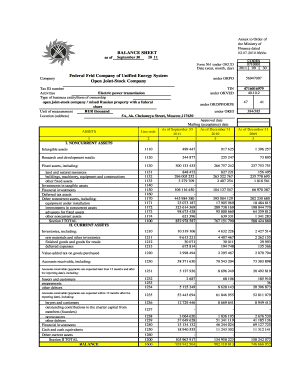

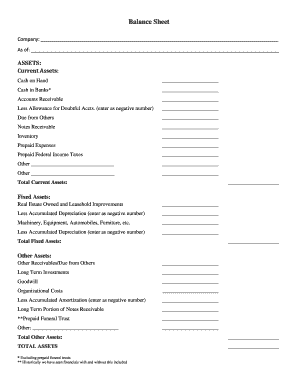

A balance sheet in Excel is a financial statement that provides a snapshot of a company's financial condition at a specific point in time. It shows the company's assets, liabilities, and shareholders' equity, allowing stakeholders to evaluate its financial health and performance.

What are the types of Balance Sheet In Excel?

There are two main types of balance sheets in Excel:

Classified Balance Sheet: This type of balance sheet groups assets and liabilities into current and non-current categories. It provides a clearer picture of a company's short-term liquidity and long-term financial stability.

Comparative Balance Sheet: This type of balance sheet compares the financials of a company over two or more time periods. It helps in analyzing the changes in assets, liabilities, and equity over time, providing insights into the company's financial trends and performance.

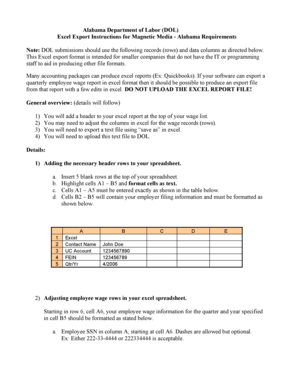

How to complete Balance Sheet In Excel

To complete a balance sheet in Excel, follow these steps:

01

Open Excel and create a new spreadsheet.

02

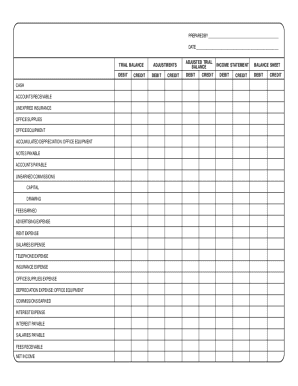

Set up the balance sheet format by creating columns for assets, liabilities, and equity.

03

List all the company's assets, such as cash, accounts receivable, inventory, and property.

04

List all the company's liabilities, such as accounts payable, loans, and accrued expenses.

05

Calculate the shareholders' equity by subtracting the total liabilities from the total assets.

06

Format the balance sheet to enhance readability, such as using borders and applying consistent formatting.

07

Review and double-check all the figures to ensure accuracy.

08

Save the completed balance sheet and share it with the necessary stakeholders.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I make a balance sheet in Excel?

How to create a balance sheet in Excel Format your worksheet. You can create a balance sheet in Excel by first creating a title section and labels for your worksheet. Enter dollar amounts. Leave a column of space between your asset labels and the location in which you want to enter the dollar amounts. Add totals.

How do you create a simple balance sheet?

How to Prepare a Basic Balance Sheet Determine the Reporting Date and Period. Identify Your Assets. Identify Your Liabilities. Calculate Shareholders' Equity. Add Total Liabilities to Total Shareholders' Equity and Compare to Assets.

What are the 3 types of balance sheets?

There are several balance sheet formats available. The more common are the classified, common size, comparative, and vertical balance sheets.

How do I construct a balance sheet?

How to Prepare a Basic Balance Sheet Determine the Reporting Date and Period. Identify Your Assets. Identify Your Liabilities. Calculate Shareholders' Equity. Add Total Liabilities to Total Shareholders' Equity and Compare to Assets.

How do you make a P&L and a balance sheet in Excel?

How to Create a Profit and Loss Statement in Excel Download, Open, and Save the Excel Template. Input Your Company and Statement Dates. Calculate Gross Profit. Input Sales Revenue to Calculate Gross Revenue. Input the Cost of Goods Sold (COGS) Calculate the Net Income. Input Your Business Expenses.

What is the formula used to create a balance sheet?

A balance sheet is calculated by balancing a company's assets with its liabilities and equity. The formula is: total assets = total liabilities + total equity. Total assets is calculated as the sum of all short-term, long-term, and other assets.

Related templates