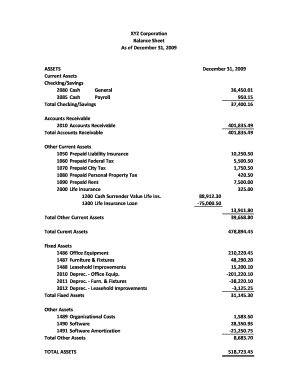

What is balance sheet template pdf?

A balance sheet template in PDF format is a standardized document that provides a snapshot of a company's financial situation at a specific point in time. It includes information about the company's assets, liabilities, and equity, which helps investors and stakeholders understand the financial health and stability of the business.

What are the types of balance sheet template pdf?

There are several types of balance sheet templates available in PDF format to meet different needs. Some common types include: 1. Simple Balance Sheet: This template includes basic information about a company's assets, liabilities, and equity. 2. Comparative Balance Sheet: This template allows for comparison of financial information between multiple periods, such as year-to-year or quarter-to-quarter. 3. Classified Balance Sheet: This template categorizes assets and liabilities into current and non-current, providing a clearer picture of the company's financial position. 4. Vertical Balance Sheet: This template presents assets, liabilities, and equity in a vertical format, making it easy to analyze the relationship between different financial elements.

How to complete balance sheet template pdf

Completing a balance sheet template in PDF format requires gathering accurate financial information and inputting it into the appropriate sections of the template. Here are the steps to complete a balance sheet template: 1. Gather financial information: Collect information about the company's assets, liabilities, and equity from financial statements and other relevant documents. 2. Organize the information: Categorize assets and liabilities into appropriate sections, such as current and non-current. 3. Calculate totals: Add up the values of assets, liabilities, and equity to determine the total amounts. 4. Input data into the template: Fill in the template with the gathered financial information, ensuring accuracy and completeness. 5. Review and verify: Double-check all the entered data for accuracy and make any necessary adjustments. 6. Save and share: Save the completed balance sheet template and share it with relevant parties, such as stakeholders or financial advisors.

pdfFiller is a leading online platform that empowers users to create, edit, and share documents in PDF format. With unlimited fillable templates and powerful editing tools, pdfFiller is the all-in-one PDF editor that users need to get their documents done efficiently and effectively.