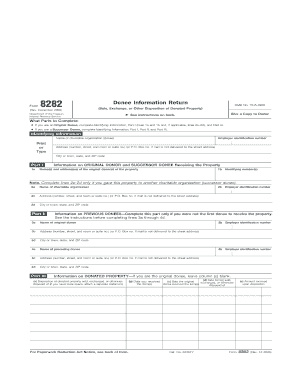

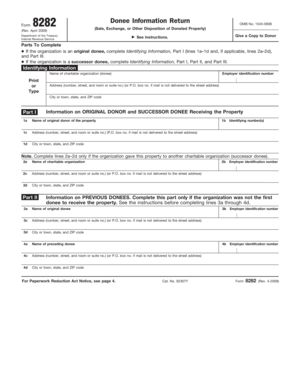

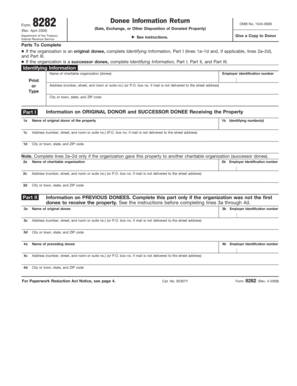

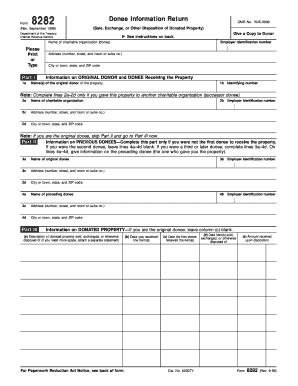

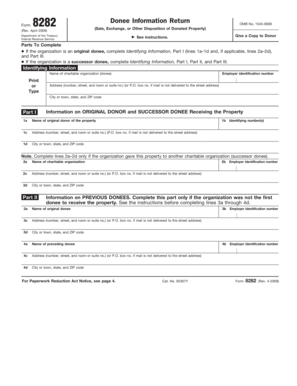

Form 8282

What is form 8282?

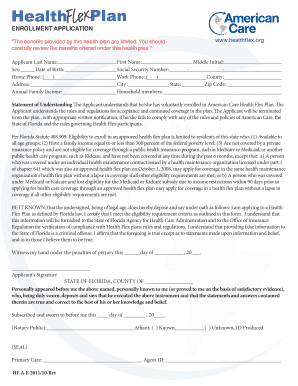

Form 8282 is a document used by taxpayers to report the sale or disposition of certain donated property. It is specifically designed for individuals or organizations who have received charitable contributions and later sell or dispose of the donated property. This form helps the Internal Revenue Service (IRS) monitor the use of donated property and ensures compliance with tax regulations.

What are the types of form 8282?

There are two types of form 8282: 1. Initial Form 8282: This is the form used to report the initial sale or disposition of donated property. It must be filed within 125 days after the date of sale or disposition. 2. Annual Form 8282: This form is used to report additional information about the donated property if there is any increase in the income tax deduction claimed for the property in prior years.

How to complete form 8282

Completing form 8282 may seem complex, but with the right guidance, it can be straightforward. Here are the steps to complete form 8282:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.