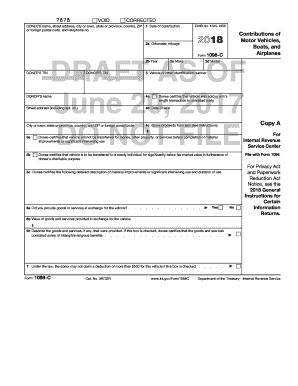

Form 1098-c

What is form 1098-c?

Form 1098-c is an important document used for reporting charitable contributions of vehicles, boats, and airplanes. It is specifically used by the organization receiving the donation to provide the donor with necessary tax information.

What are the types of form 1098-c?

There are two main types of form 1098-c:

Form 1098-c, Contributions of Motor Vehicles, Boats, and Airplanes

Form 1098-c, Contributions of Motor Vehicles, Boats, and Airplanes (Section 30B(f) Election)

How to complete form 1098-c

Completing form 1098-c involves a few essential steps:

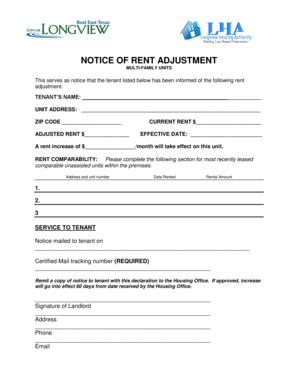

01

Provide the donor and organization information

02

Enter the vehicle, boat, or airplane details

03

Determine the amount of deduction allowed

04

Submit the completed form to the donor

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out form 1098-c

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you read a 1098?

On your 1098 tax form is the following information: Box 1 – Interest paid, not including points. Box 2 – Outstanding mortgage principle. Box 3 – Mortgage origination date. Box 4 – Refund of overpaid interest. Box 5 – Mortgage insurance premiums. Box 6 – Mortgage points you might be able to deduct.

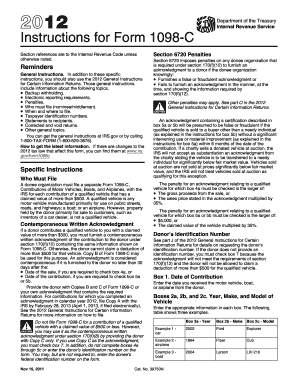

Do I need to file 1098-C?

A donee organization must file a separate Form 1098-C with the IRS for each contribution of a qualified vehicle that has a claimed value of more than $500. A qualified vehicle is: Any motor vehicle manufactured primarily for use on public streets, roads, and highways.

How does a 1098-C affect my taxes?

When you donate a vehicle to charity, you may be able to deduct it as a charitable contribution if you itemize your deductions. Soon after donating a vehicle, boat or airplane, the charitable organization may send you a Form 1098-C that reports details about the donation that may impact your deduction.

What is the best charity to donate a car to?

5 Best Car Donation Charities Habitat for Humanity. Habitat for Humanity accepts donated cars, trucks, motorcycles, recreational vehicles, boats, snowmobiles, farm equipment and construction equipment. Ronald McDonald House Charities. The Salvation Army. Goodwill. Canine Companions for Independence.

What is a 1098?

The 1098-T, Tuition Statement form reports tuition expenses you paid for college tuition that might entitle you to an adjustment to income or a tax credit.

How do I donate a car in NY?

For immediate scheduling of a donation, please call 1-877-646-1976. Our experienced car donation representatives are available anytime to assist you with the entire vehicle donation process. You can also complete a donation form online. The process of donating a vehicle is simple, and only takes a moment of your time.

Related templates