Household Budget Percentages

What is household budget percentages?

Household budget percentages refer to the portion of income or expenses allocated to different categories in a budget. It helps individuals or families manage their finances effectively by setting limits and priorities for spending and saving.

What are the types of household budget percentages?

The types of household budget percentages vary depending on individual circumstances and financial goals. Some common categories include:

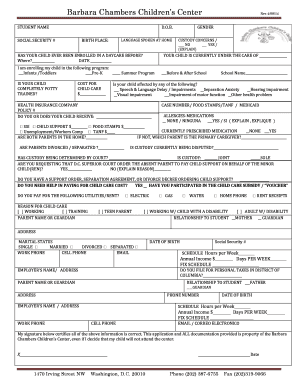

Housing: This category includes rent or mortgage payments, property taxes, and home maintenance expenses.

Transportation: It covers expenses related to owning a car, such as fuel, insurance, and maintenance costs.

Food: This category includes groceries, dining out, and snacks or drinks bought outside.

Utilities: It includes bills for electricity, water, gas, internet, and other essential services.

Debt payments: This category covers loan repayments, credit card bills, and other outstanding debts.

Savings: It represents the percentage of income allocated for saving and investing for future goals.

Entertainment: This category covers expenses related to leisure activities, hobbies, and entertainment.

Healthcare: It includes expenses for health insurance premiums, medications, and healthcare services.

Education: This category covers expenses related to tuition fees, books, and other educational expenses.

Miscellaneous: It represents a flexible portion of the budget for unexpected or miscellaneous expenses.

How to complete household budget percentages

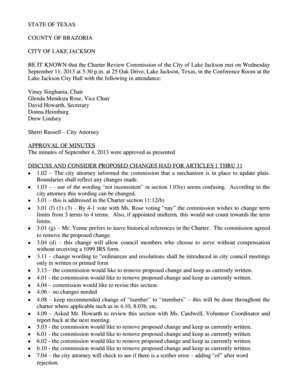

Completing household budget percentages can be done in a few steps:

01

Calculate your total monthly income.

02

Determine your fixed expenses like rent, utilities, and debt payments.

03

Allocate a percentage of income to each budget category based on your financial goals and priorities.

04

Adjust the percentages as needed to ensure your expenses do not exceed your income.

05

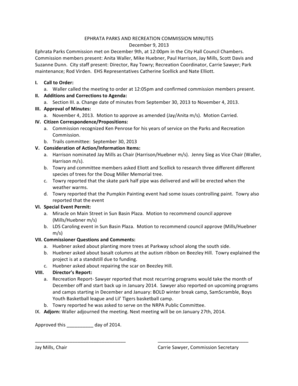

Monitor and track your expenses regularly to ensure you stay within your budget.

06

Make necessary adjustments to your budget percentages over time as your financial situation and goals change.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

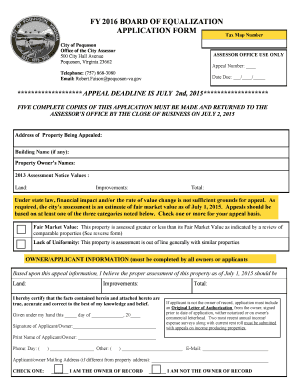

How do you calculate budget?

How to create a budget Calculate your net income. List monthly expenses. Label fixed and variable expenses. Determine average monthly costs for each expense. Make adjustments.

How do I create a budget percentage?

Try the 50/30/20 rule as a simple budgeting framework. Allow up to 50% of your income for needs. Leave 30% of your income for wants. Commit 20% of your income to savings and debt repayment.

What's the 50 30 20 budget rule?

The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

When budgeting What is the 50 30 20 rule?

The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt. By regularly keeping your expenses balanced across these main spending areas, you can put your money to work more efficiently.

What are the percentages for a household budget?

Recommended Ideal Household Budget Percentages CategoryIdeal Recommended PercentagesGiving10%Savings15-25%Housing20-30%Utilities4-7%10 more rows

What percentages should I use for my budget?

The 50-20-30 budgeting method Use 50% of the money you earn for necessary expenses, such as housing and transportation. Use 20% of your income to gain financial traction. Lastly, 30% of your income can be used on anything you want.

Related templates