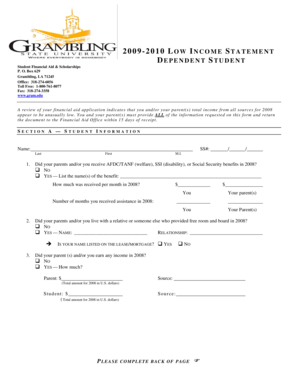

How To Prepare An Income Statement

What is how to prepare an income statement?

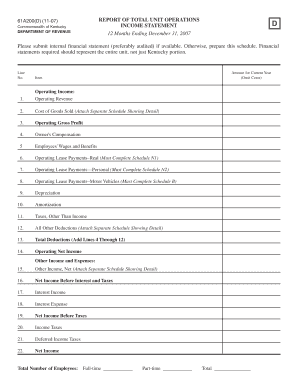

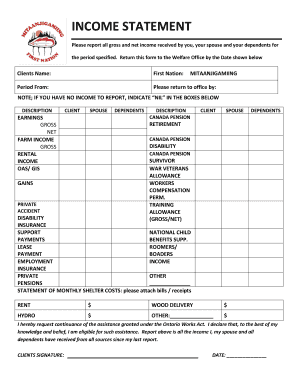

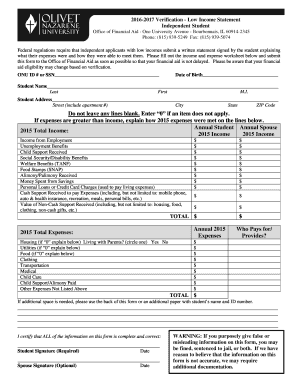

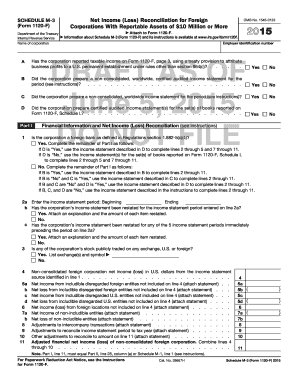

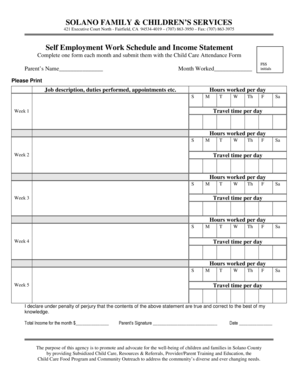

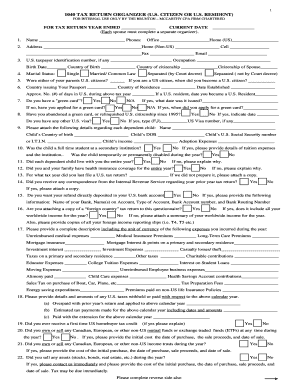

Preparing an income statement is the process of documenting and presenting the financial performance of a business for a specific time period. It includes recording revenue and expenses to determine the net income or loss for the period.

What are the types of how to prepare an income statement?

There are two main types of income statements: single-step and multi-step income statements. A single-step income statement calculates net income by subtracting total expenses from total revenues. On the other hand, a multi-step income statement includes multiple sections to analyze various aspects of the business's financial performance.

How to complete how to prepare an income statement

To complete an income statement, follow these steps:

pdfFiller is a powerful online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and professionally.