What is limited partnership agreement canada?

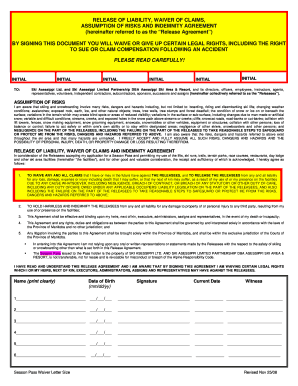

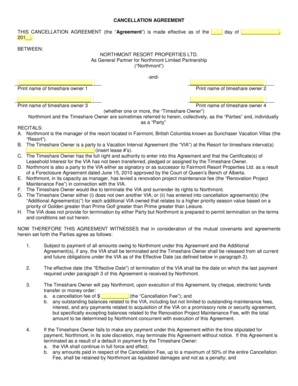

A limited partnership agreement in Canada is a legal document that outlines the rights, roles, and responsibilities of the partners involved in a limited partnership. It sets out the terms and conditions under which the partnership will operate, including the capital contributions, profit-sharing arrangements, decision-making processes, and the duration of the partnership.

What are the types of limited partnership agreement canada?

There are several types of limited partnership agreements in Canada, including:

General Limited Partnership: In this type, there is at least one general partner who has unlimited liability and is actively involved in the management of the partnership.

Limited Liability Limited Partnership: This type offers limited liability protection to all partners, including the general partner. It is commonly used in situations where multiple general partners are involved.

Master Limited Partnership: This type involves a master limited partnership that controls one or more additional limited partnerships. It is often used for complex business structures and investment funds.

Limited Partnership with a Corporate General Partner: In this type, a corporation acts as the general partner, providing liability protection to individual partners.

Publicly Traded Limited Partnership: This type allows the limited partnership units to be traded on public exchanges, giving investors liquidity.

Foreign Limited Partnership: This type involves a partnership formed in a foreign jurisdiction but registered to do business in Canada.

How to complete limited partnership agreement canada

To complete a limited partnership agreement in Canada, follow these steps:

01

Gather the necessary information about the partners, such as their names, addresses, capital contributions, and roles within the partnership.

02

Draft the agreement using a template or seek legal advice to ensure compliance with applicable laws and regulations.

03

Include provisions regarding the management of the partnership, profit-sharing, decision-making processes, and dispute resolution mechanisms.

04

Clearly outline the rights, responsibilities, and restrictions of each partner.

05

Review and revise the agreement as needed to reflect the interests and objectives of all partners.

06

Have all partners sign the agreement and keep a copy for record-keeping purposes.

07

Periodically review the agreement and make amendments as necessary to accommodate changes in the partnership structure or external circumstances.

pdfFiller is an excellent tool to help you create and complete your limited partnership agreement in Canada. With pdfFiller, you can effortlessly generate custom-made agreements, edit them to fit your needs, and securely share them online. Whether you need to create a new agreement from scratch or modify an existing one, pdfFiller's unlimited fillable templates and powerful editing tools make the process quick and easy. Empower yourself with pdfFiller to streamline your document management and ensure your limited partnership agreement is comprehensive and legally sound.