What is mileage reimbursement form irs?

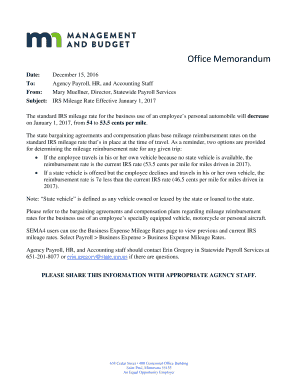

A mileage reimbursement form IRS is a document used by individuals to claim reimbursement for the expenses they incur while using their personal vehicles for business or work purposes. The IRS requires this form to be filled out accurately and submitted as supporting documentation for tax purposes. It helps individuals receive reimbursement for the miles they have driven for work-related activities.

What are the types of mileage reimbursement form irs?

There are different types of mileage reimbursement forms IRS depending on the purpose and eligibility criteria. The common types include:

Standard Mileage Rate: This form is used by individuals who want to claim a deduction based on the standard mileage rate set by the IRS. It requires the individuals to keep track of the total miles driven for work purposes.

Actual Expenses Method: This form is used by individuals who want to claim deductions for the actual expenses incurred while using their vehicle for work-related activities. It includes fuel costs, maintenance expenses, and other vehicle-related expenditures.

How to complete mileage reimbursement form irs

To complete a mileage reimbursement form IRS, follow these steps:

01

Gather necessary information: Collect all the receipts, records, and documents related to your vehicle expenses. This may include fuel receipts, maintenance records, and any other relevant evidence.

02

Fill in personal information: Provide your name, address, social security number, and other required personal details accurately.

03

Record mileage details: Track the total miles driven for work or business purposes during the tax year. Note down starting and ending mileage for each trip.

04

Choose the right reimbursement method: Decide whether you want to claim deductions based on the standard mileage rate or actual expenses method.

05

Calculate deductions: Use the appropriate method to calculate the deductions based on the IRS guidelines and regulations.

06

Submit the form: Make sure to review the completed form for accuracy and attach all the necessary supporting documentation. Submit it to the IRS according to the specified deadlines.

pdfFiller, an online document management platform, empowers users to create, edit, and share documents seamlessly. It offers unlimited fillable templates and powerful editing tools, making it the perfect solution for completing mileage reimbursement forms IRS. With pdfFiller, users can conveniently fill out the necessary fields, add digital signatures, and securely submit the completed form to the IRS for reimbursement. Try pdfFiller today and experience the ease of managing your documents efficiently.