What is home equity loan fixed rates?

A home equity loan with fixed rates is a type of loan that allows homeowners to borrow money based on the equity they have built up in their property. The interest rate for this type of loan remains fixed for the duration of the loan, meaning that the monthly payments will remain the same. This provides borrowers with stability and predictability, making it easier to budget for their monthly expenses.

What are the types of home equity loan fixed rates?

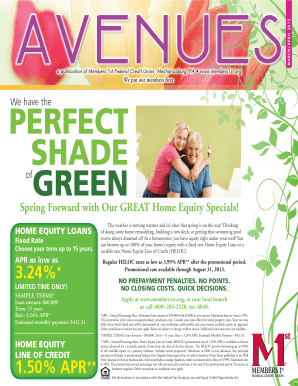

There are two main types of home equity loan fixed rates: traditional home equity loans and home equity lines of credit (HELOCs).

Traditional home equity loans: With a traditional home equity loan, borrowers receive a lump sum of money and repay it over a set period of time, usually with a fixed interest rate. This type of loan is ideal for larger expenses, such as home renovations or debt consolidation.

Home equity lines of credit (HELOCs): HELOCs function more like a credit card, where homeowners have access to a line of credit based on their home equity. Borrowers can withdraw funds as needed and only pay interest on the amount they borrow. The interest rate for a HELOC may be variable, but some lenders offer the option to convert it to a fixed rate if desired.

How to complete home equity loan fixed rates

Completing a home equity loan with fixed rates involves the following steps:

01

Determine the amount of equity in your home: Calculate the current market value of your home and subtract any outstanding mortgage balances to determine how much equity you have.

02

Research lenders and compare offers: Shop around and compare interest rates, fees, and loan terms from different lenders to find the best home equity loan option for you.

03

Gather necessary documents: Prepare the documents needed for the loan application, such as proof of income, bank statements, and property valuation reports.

04

Submit your application: Fill out the loan application and provide all required documents to the lender. Be prepared for a thorough review and underwriting process.

05

Close the loan: If approved, review the loan terms and sign the necessary documents. The lender will then disburse the funds, and you can start using the loan for your intended purpose.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.