What is Home Equity Calculator?

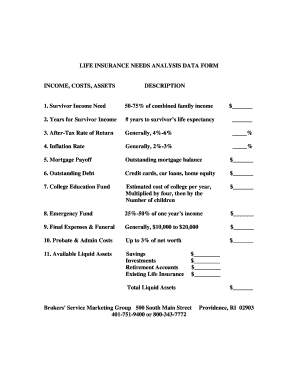

A Home Equity Calculator is a useful tool that allows individuals to estimate the amount of equity they have in their home. Equity is the difference between the current market value of a property and the amount still owed on the mortgage. By entering relevant information about a property, such as its current value, any outstanding mortgage balance, and other factors, the calculator can give an estimate of the homeowner's equity.

What are the types of Home Equity Calculator?

There are various types of Home Equity Calculators available. Here are some common types:

Online Home Equity Calculator: This type of calculator can be accessed and used directly through a website or portal. Users can simply enter the required details and the calculator will process the information to provide an estimate of their home equity.

Mobile Home Equity Calculator: These calculators are specifically designed to be used on mobile devices such as smartphones and tablets. They offer the convenience of calculating home equity on the go.

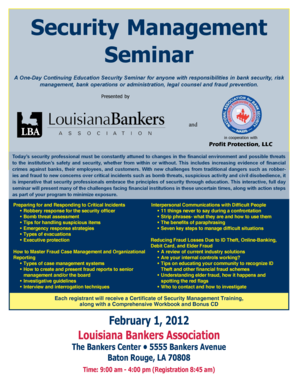

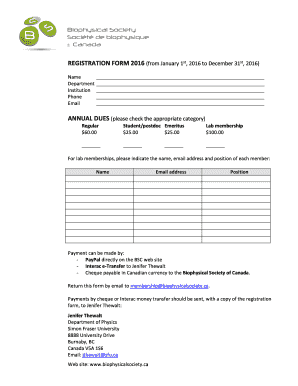

Financial Institution Home Equity Calculator: Many banks and financial institutions provide their own Home Equity Calculators as a part of their online services. These calculators may have additional features and functions tailored to the specific institution's offerings.

Desktop Home Equity Calculator: Some individuals prefer to use a downloadable software or program installed on their computer to calculate home equity. These calculators usually offer more advanced features and customization options.

How to complete Home Equity Calculator

Completing a Home Equity Calculator is a straightforward process. Here are the steps to follow:

01

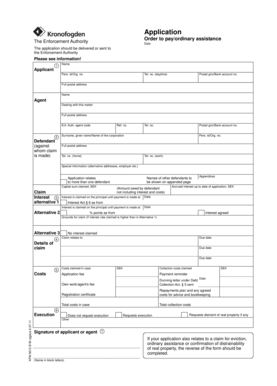

Gather the required information: You will need to collect details such as the current market value of your home, the amount owed on your mortgage, and any additional debts secured by the property.

02

Access a Home Equity Calculator: You can find various Home Equity Calculators online through search engines or by visiting financial institution websites.

03

Enter the relevant information: Input the collected information into the calculator's fields. Be sure to double-check the accuracy of the data.

04

Review the results: Once you have submitted the necessary information, the calculator will provide an estimate of your home equity. Take the time to review and understand the results.

05

Consider consulting a professional: If you have any questions or concerns about the accuracy or implications of the calculator's estimate, it is advisable to consult a mortgage or financial professional for further guidance.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.