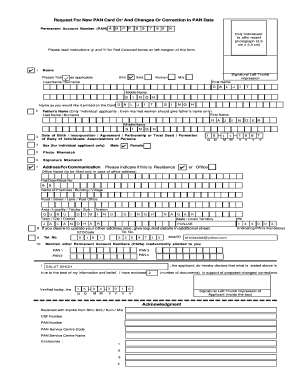

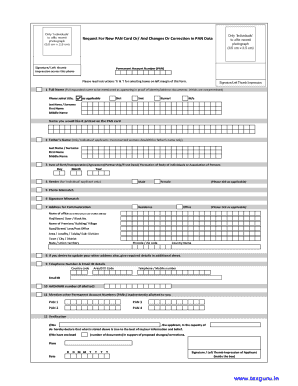

Pan Card Correction Form

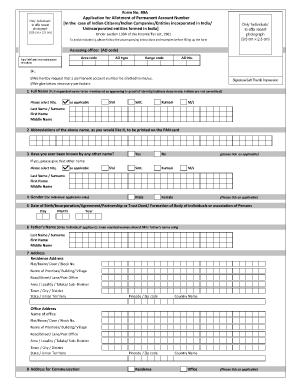

What is Pan Card Correction Form?

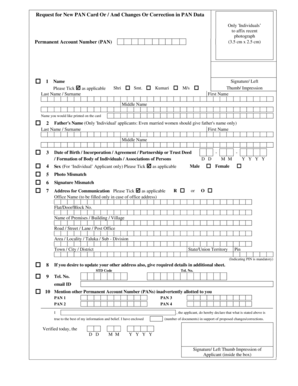

Pan Card Correction Form is a document that allows individuals to make corrections or update their information on their Pan Card. It is used when there are errors or changes in the applicant's personal or financial details such as name, address, date of birth, or other relevant data. By filling out this form, individuals can ensure that their Pan Card reflects accurate and up-to-date information.

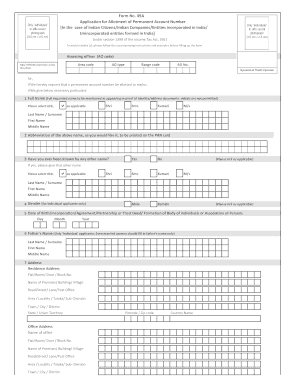

What are the types of Pan Card Correction Form?

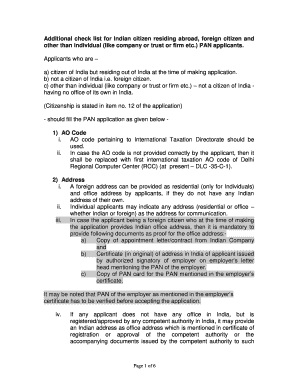

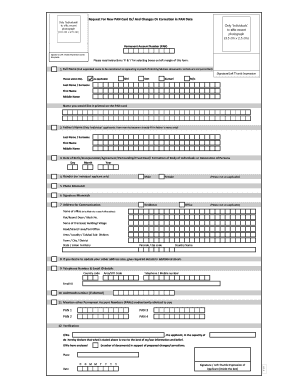

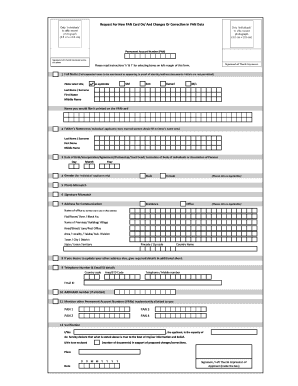

There are two types of Pan Card Correction Forms: 1. Form 49A: This form is used for Indian citizens, Indian companies, and entities incorporated in India. 2. Form 49AA: This form is used by individuals or entities who are not citizens of India, such as foreign companies or non-resident Indians.

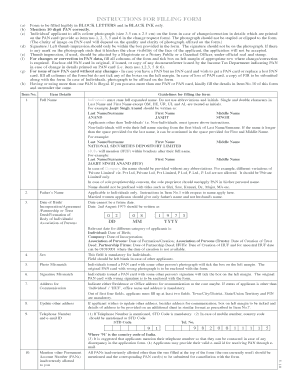

How to complete Pan Card Correction Form

To complete the Pan Card Correction Form, follow these steps: 1. Download the form from the official website of the Income Tax Department. 2. Fill in the required personal and financial details accurately. 3. Attach any necessary supporting documents, such as proof of address or identity. 4. Double-check all the information provided and make sure it is correct and up-to-date. 5. Submit the form and supporting documents to the nearest Pan Card office or submit it online if an online submission option is available. 6. Pay any applicable fees for the correction process, if required. 7. Keep a copy of the submitted form and acknowledgment receipt for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.