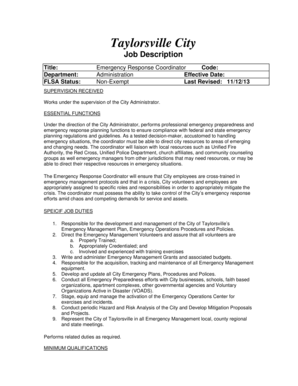

Irs Forms 1040ez

What is irs forms 1040ez?

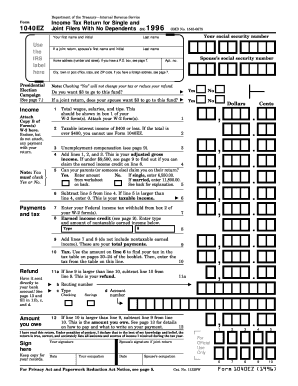

IRS Forms 1040EZ, also known as the Income Tax Return for Single and Joint Filers with No Dependents, is a simplified version of the standard IRS Form 1040. It is designed for taxpayers with straightforward tax situations, such as those who have no dependents and claim the standard deduction. The 1040EZ form is shorter and easier to fill out compared to the regular 1040 form, making it a convenient option for eligible taxpayers.

What are the types of irs forms 1040ez?

There are no specific types of IRS Forms 1040EZ. The form itself is the same for all eligible taxpayers, regardless of their specific circumstances. However, it is important to note that the 1040EZ form may not be suitable for everyone. For example, if you have dependents, itemize deductions, or have other complexities in your tax situation, you may need to use the regular 1040 form instead.

How to complete irs forms 1040ez

Completing IRS Forms 1040EZ is a straightforward process. Here are the steps to follow:

For an easier and more efficient way to complete IRS Forms 1040EZ, you can use pdfFiller. pdfFiller empowers users to create, edit, and share documents online, including the 1040EZ form. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done quickly and accurately.