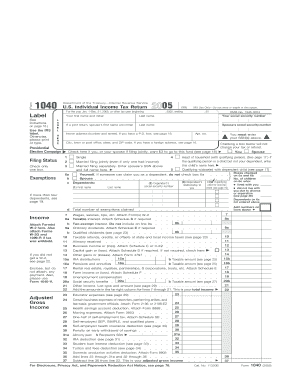

What is IRS Form 1040 Instructions?

IRS Form 1040 Instructions is a set of guidelines provided by the Internal Revenue Service (IRS) to help taxpayers accurately complete their Form 1040, which is the standard individual income tax return form in the United States. These instructions include important information about how to report income, claim deductions and credits, and calculate taxes owed or refunds.

What are the types of IRS Form 1040 Instructions?

The IRS provides different types of Form 1040 Instructions based on the complexity of the taxpayer's financial situation. These instructions include:

Form 1040 Instructions: This is the general set of instructions applicable to most taxpayers with straightforward tax situations.

Form 1040A Instructions: This simplified version is available for taxpayers who meet certain criteria, such as having income only from wages, salaries, tips, interest, or dividends.

Form 1040EZ Instructions: This is the simplest version of the instructions, designed for taxpayers with no dependents and who meet specific income and filing status requirements.

How to complete IRS Form 1040 Instructions

Completing IRS Form 1040 Instructions may seem daunting, but by following these steps, you can ensure accuracy and avoid potential errors:

01

Gather all necessary documents, such as W-2 forms, 1099 forms, and any other documents related to your income and deductions.

02

Carefully read the instructions provided by the IRS for the specific version of Form 1040 that applies to your situation.

03

Enter your personal information, including your name, social security number, and filing status.

04

Report your income sources and amounts accurately, making sure to include all necessary details.

05

Claim applicable deductions and credits, following the instructions provided for each specific deduction or credit.

06

Calculate your tax liability or refund using the provided calculations and tables.

07

Double-check all the entered information to ensure accuracy.

08

Sign and date the form prior to submission.

09

Keep a copy of the completed Form 1040 and all supporting documentation for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently.