California Tax Forms

What is california tax forms?

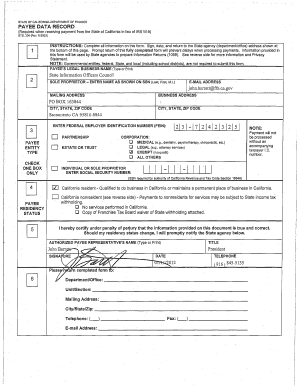

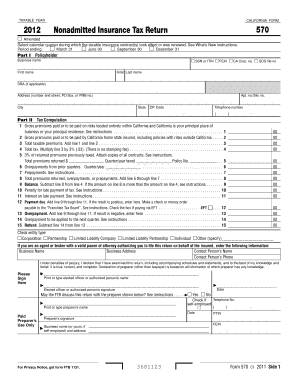

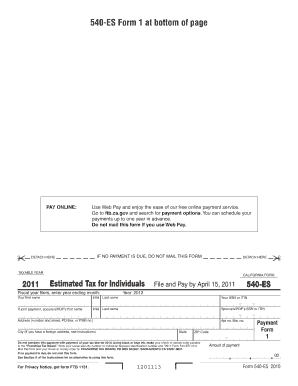

California tax forms refer to the various documents that individuals and businesses in California need to complete and submit to report their income and calculate their tax liability. These forms are used to determine the amount of state taxes owed or any refund that may be due. The forms contain important information such as personal details, income sources, deductions, and credits.

What are the types of california tax forms?

There are several types of California tax forms that individuals and businesses may need to fill out: 1. Form 540: California Resident Income Tax Return - used by individuals who are residents of California and have taxable income. 2. Form 540NR: California Nonresident or Part-Year Resident Income Tax Return - used by individuals who lived in California for part of the year or are nonresidents but earned income from California sources. 3. Form 100: California Corporation Franchise or Income Tax Return - used by corporations or LLCs taxed as corporations to report their income and calculate their tax liability. 4. Form 109: California Exempt Organization Annual Information Return - used by nonprofit organizations to report their financial information to the California Franchise Tax Board.

How to complete california tax forms

Completing California tax forms can seem daunting, but with the right information, it can be done easily. Here are the steps to complete California tax forms: 1. Gather all necessary documents such as W-2 forms, 1099 forms, and any other income documentation. 2. Download the required California tax forms from the California Franchise Tax Board website or use an online tax preparation software. 3. Fill in your personal details, income information, deductions, and credits on the appropriate sections of the forms. 4. Double-check all the information you entered for accuracy and completeness. 5. Sign and date the forms. 6. Submit the completed forms to the California Franchise Tax Board by mail or electronically, depending on the filing method you choose. Remember to keep a copy of your completed forms and supporting documents for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.