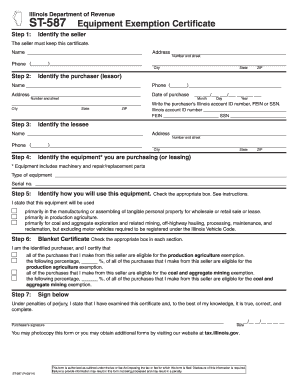

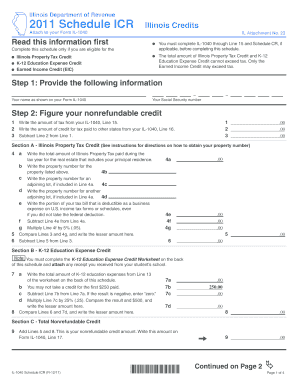

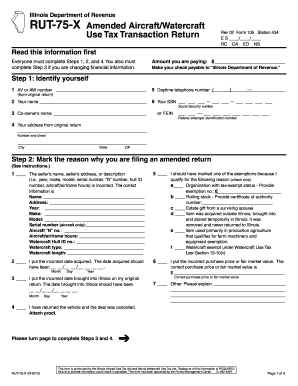

Illinois Tax Forms

What is illinois tax forms?

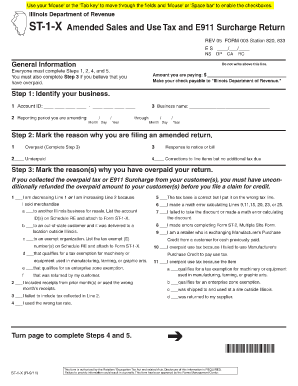

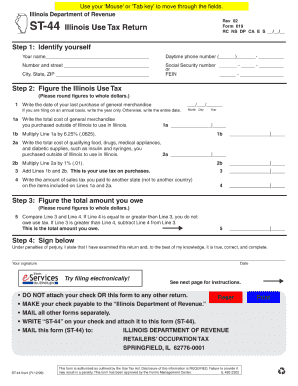

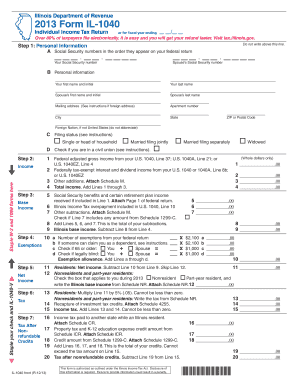

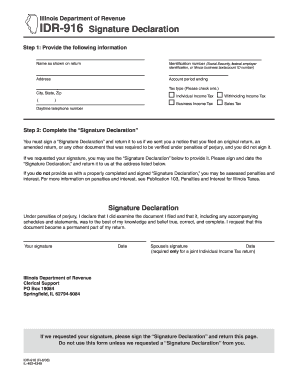

Illinois tax forms are official documents used by individuals and businesses in the state of Illinois to report their income, deductions, and calculate their tax liability. These forms are necessary for filing state taxes and are used to determine the amount of tax owed or the refund to be received.

What are the types of illinois tax forms?

There are several types of Illinois tax forms, including: 1. IL-1040: This is the individual income tax return form, used by residents to report their income, deductions, and tax liabilities. 2. IL-1040-ES: Estimated Income Tax Payments for Individuals. This form is used to make quarterly estimated tax payments throughout the year. 3. IL-1040-X: Amended Individual Income Tax Return. This form is used to correct errors or make changes to a previously filed IL-1040. 4. IL-1065: Partnership Replacement Tax Return. This form is used by partnerships doing business in Illinois. 5. IL-1120: Corporation Income and Replacement Tax Return. This form is used by corporations doing business in Illinois.

How to complete illinois tax forms

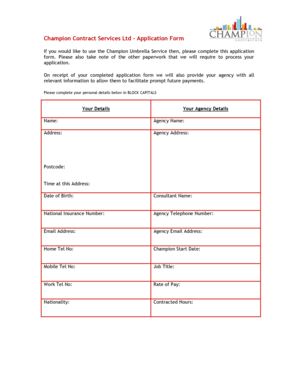

Completing Illinois tax forms can seem overwhelming, but with the right guidance, it can be a straightforward process. Here is a step-by-step guide: 1. Gather your documents: Collect all relevant financial documents, including W-2 forms, 1099 forms, and any other income or deduction records. 2. Choose the appropriate form: Determine which form is applicable to your tax situation (e.g., IL-1040 for individuals). 3. Fill in personal information: Provide your name, address, Social Security number, and other required information. 4. Report income: Enter all sources of income and fill in the corresponding sections. 5. Deductions and credits: Calculate and claim any eligible deductions and credits. 6. Calculate tax liability: Follow the instructions on the form to calculate your tax liability or refund. 7. Review and submit: Review the completed form for accuracy and sign it before submitting it to the Illinois Department of Revenue.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.