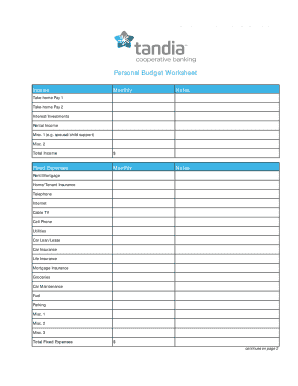

Personal Budget Worksheet

What is a personal budget worksheet?

A personal budget worksheet is a tool that helps individuals track their income and expenses. It allows you to see where your money is going, make adjustments to your spending habits, and plan for future financial goals.

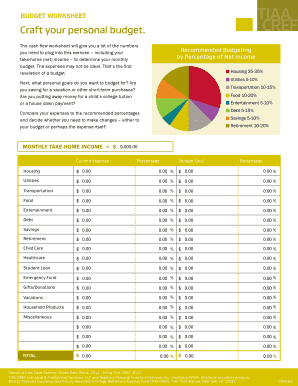

What are the types of personal budget worksheets?

There are several types of personal budget worksheets available, including: Monthly budget worksheets, Yearly budget worksheets, Zero-based budget worksheets, Envelope system budget worksheets, and Percentage-based budget worksheets.

How to complete a personal budget worksheet

Completing a personal budget worksheet is simple and can be broken down into the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.