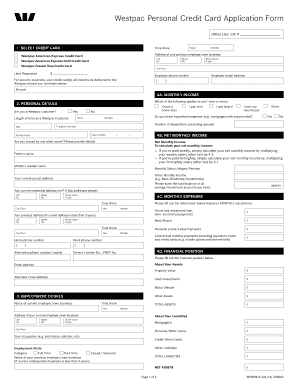

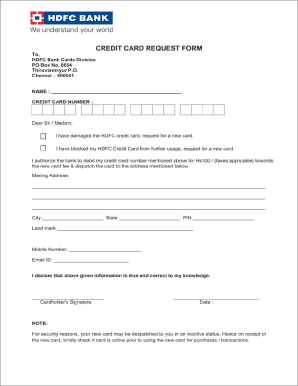

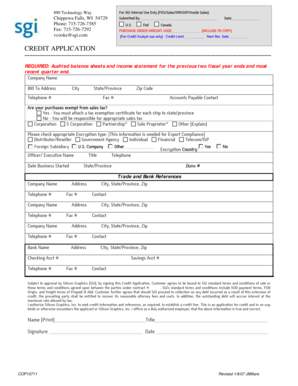

What is personal credit application form?

A personal credit application form is a document that individuals use to apply for credit from financial institutions or lenders. It typically includes personal information such as name, address, contact details, employment history, and financial information. This form provides lenders with the necessary information to assess an individual's creditworthiness and determine if they qualify for a loan or credit.

What are the types of personal credit application form?

There are various types of personal credit application forms that cater to different purposes and situations. Some common types include:

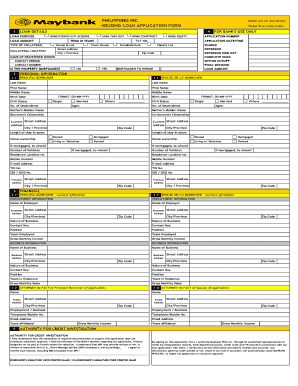

Secured personal credit application form: This form is used when the borrower needs to provide collateral, such as an asset or property, to secure the loan. It offers the lender more security in case of default.

Unsecured personal credit application form: This form does not require any collateral and is based solely on the borrower's creditworthiness. It is commonly used for smaller loan amounts or credit cards.

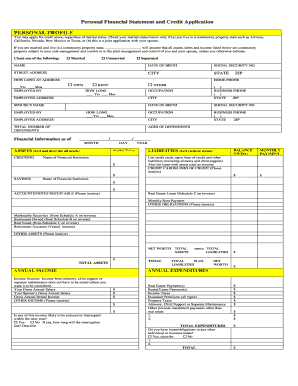

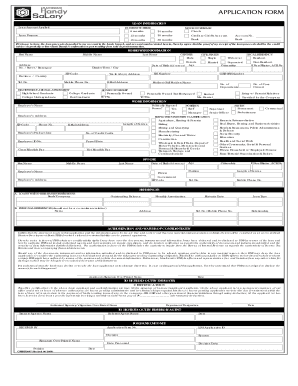

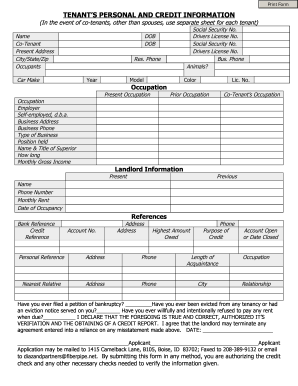

Joint personal credit application form: This form is used when two or more individuals apply for credit together. It allows the lenders to assess the creditworthiness of each applicant and hold them jointly responsible for the debt.

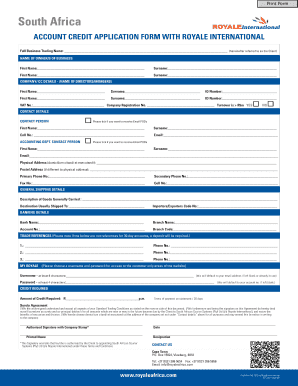

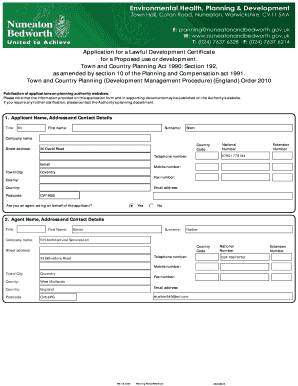

Business credit application form: This form is designed for individuals who are applying for credit on behalf of a business. It includes both personal and business information to assess the creditworthiness of the business.

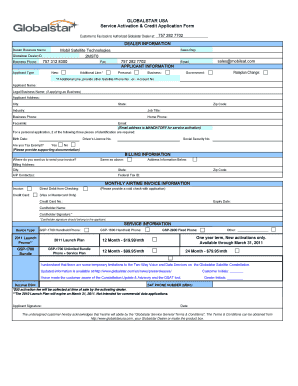

Instant personal credit application form: This form is used for quick and easy online credit applications. It often requires less documentation and provides instant approval or denial based on the provided information.

How to complete personal credit application form?

Completing a personal credit application form is a straightforward process. Here are the steps you should follow:

01

Gather all the necessary documents and information, such as identification proof, address proof, income details, and employment history.

02

Read the form carefully and fill in your personal information accurately, including your full name, address, contact details, and social security number.

03

Provide information about your employment, including your current job title, employer's name, and contact details.

04

Provide detailed information about your financial situation, such as your income, expenses, assets, and liabilities.

05

Review the completed form to ensure all information is accurate and complete.

06

Sign the form and submit it to the lender along with any additional required documents.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.