What is a commercial credit application form?

A commercial credit application form is a document that businesses use to apply for credit from suppliers, lenders, or other organizations. It is an important tool for businesses to establish creditworthiness and gain access to financing options. The form typically includes information about the business, such as its name, address, legal structure, and financial details. The purpose of the form is to provide the creditor with necessary information to assess the business's creditworthiness and determine the terms and conditions of the credit.

What are the types of commercial credit application forms?

There are different types of commercial credit application forms available, depending on the specific requirements of the creditor or lending institution. Some common types include:

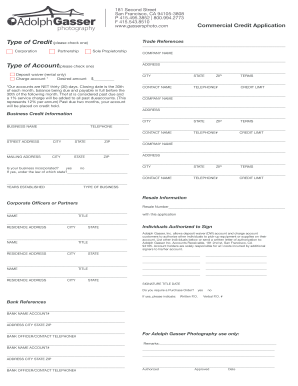

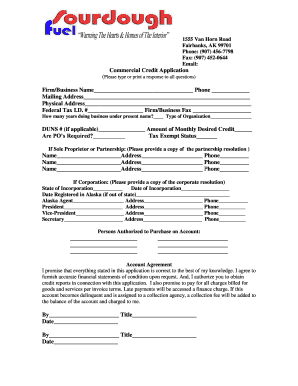

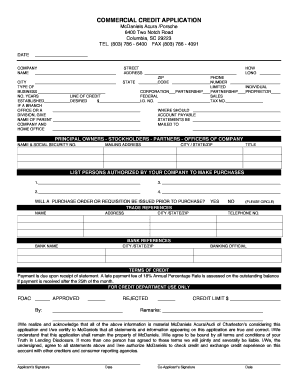

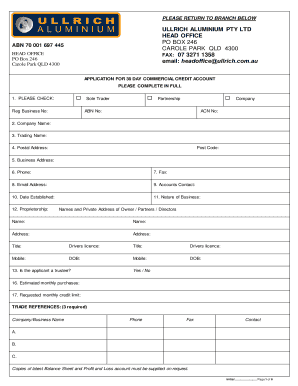

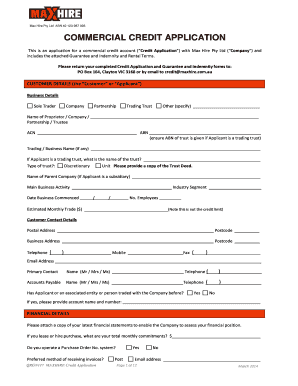

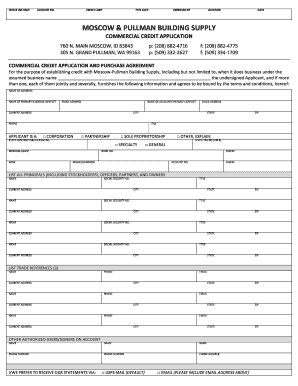

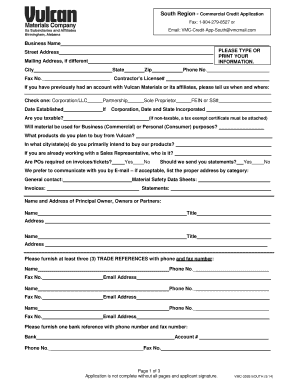

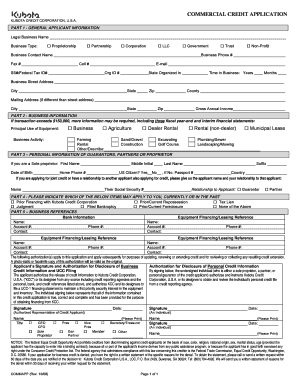

Standard commercial credit application form: This is a generic form used by many businesses to apply for credit. It includes basic information about the business and its financial details.

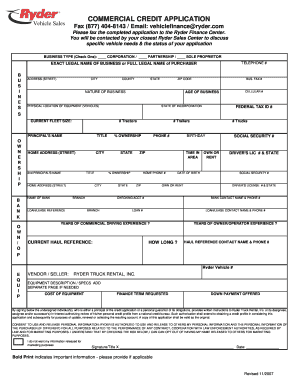

Vendor-specific commercial credit application form: Some vendors or suppliers have their own customized application forms that businesses need to fill out to apply for credit with them. These forms may include additional fields specific to the vendor's requirements.

Bank credit application form: Banks have their own application forms for businesses that want to apply for credit. These forms may be more comprehensive and require detailed financial information about the business.

Government credit application form: Government agencies may have their own application forms for businesses that want to avail of government-backed credit programs. These forms may have specific requirements and eligibility criteria.

How to complete a commercial credit application form?

Completing a commercial credit application form may seem daunting, but by following these steps, you can easily provide the necessary information:

01

Gather all the required documents: Before you start filling out the form, gather all the necessary documents such as business licenses, financial statements, tax returns, and any other relevant documents.

02

Provide accurate business information: Fill out the form with accurate and up-to-date information about your business, including its name, address, legal structure, and contact details. Make sure to double-check the information for any errors or typos.

03

Include financial details: Provide detailed financial information about your business, such as revenue, expenses, assets, liabilities, and any outstanding debts. Be thorough and transparent in this section.

04

Attach supporting documents: If required, attach supporting documents such as bank statements, income statements, or any other financial documentation that demonstrates your business's financial health.

05

Review and submit: Before submitting the application form, review it carefully to ensure all the information is accurate and complete. Once you have reviewed the form, submit it to the creditor or lending institution as per their instructions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.