Ryder Commercial Credit Application 2007-2025 free printable template

Show details

COMMERCIAL CREDIT APPLICATION Vehicle Sales Fax (877) 404-8143 / Email: vehicle finance ryder.com Please fax the completed application to the Ryder Finance Center. You will be contacted by your closest

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ryder financing

Edit your ryder financing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ryder financing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ryder financing online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ryder financing. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ryder financing

How to fill out Ryder Commercial Credit Application

01

Start by downloading the Ryder Commercial Credit Application form from the official Ryder website or obtaining a physical copy from a Ryder location.

02

Fill in your business information, including the legal name, address, phone number, and email of your business.

03

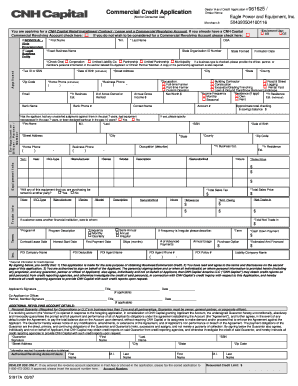

Provide details about the type of business (LLC, Corporation, etc.) and federal tax ID number.

04

Include information about the owners or key personnel, such as names, titles, and social security numbers.

05

Specify the type of credit requested, including the credit limit and purpose of the credit.

06

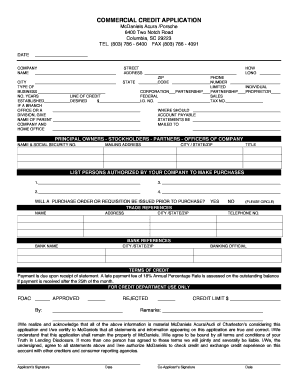

List your trade references, including names, contact information, and account numbers.

07

Fill out the financial information section, providing details about your business's financial status, including annual revenue and bank references.

08

Read and agree to the terms and conditions outlined in the application.

09

Sign and date the application in the designated areas.

10

Submit the completed application either online or by mailing it to the appropriate Ryder office.

Who needs Ryder Commercial Credit Application?

01

Businesses looking to establish credit with Ryder for purchasing trucks or services.

02

Companies that need financing solutions for their logistics and transportation needs.

03

Freight carriers seeking to manage their cash flow better through credit options.

04

Organizations requiring rental or leasing solutions and wish to utilize Ryder’s services.

Fill

form

: Try Risk Free

People Also Ask about

What is financing a truck?

You agree to pay, over a period of time, the amount financed, plus a finance charge. Once you enter into a contract with a dealership to buy a vehicle, you use the loan from the direct lender to pay for the vehicle.

How to finance a work truck?

How do you finance a commercial truck? Determine your down payment. Knowing how much you can afford is a good start when buying any vehicle. Find the truck you want — and lenders that will fund it. What kind of truck you need will have a direct impact on financing options. Compare loans. Gather paperwork and apply.

What is a truck loan?

A truck loan is a financial product that allows you to purchase a truck, car, van, or other commercial vehicle for your business. Typically, borrowers seek truck loans from their automobile dealer or a major bank. The most common use for a truck loan is purchasing or refinancing the purchase of a commercial vehicle.

Does Ryder make trucks?

Under full-service leasing Ryder owns and maintains the trucks and the customer decides where they go.

What is the best way to finance a truck?

Borrowers generally choose bank financing if they have large amounts to finance and are okay with a longer approval process. Credit unions offer preferential rates for their members. On the other hand, go with dealership financing if you prefer a quick approval process and longer terms.

How much is a downpayment on a truck?

A down payment between 10 to 20 percent of the vehicle price is the general recommendation.

Are Ryder trucks automatic?

2 answers. Both automatic transmission and manual transmission depending on customer needs.

How does a truck loan work?

Commercial truck financing involves a business owner using their truck as collateral for a loan, which reduces the risk for the lender. Similar to a car loan, the lender holds the title of your truck until you pay off your debt, and it could seize the vehicle if you fail to meet your loan obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ryder financing straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing ryder financing.

Can I edit ryder financing on an Android device?

You can edit, sign, and distribute ryder financing on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out ryder financing on an Android device?

Use the pdfFiller mobile app to complete your ryder financing on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

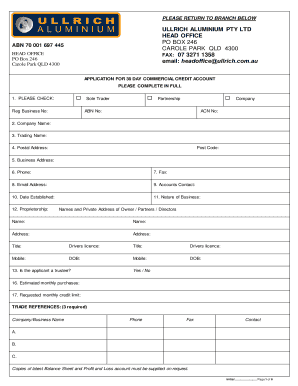

What is Ryder Commercial Credit Application?

Ryder Commercial Credit Application is a formal document used by businesses to apply for credit services offered by Ryder, allowing them to access financing for transportation and logistics solutions.

Who is required to file Ryder Commercial Credit Application?

Businesses that wish to establish a credit account with Ryder for transportation or logistics services are required to file the Ryder Commercial Credit Application.

How to fill out Ryder Commercial Credit Application?

To fill out the Ryder Commercial Credit Application, businesses need to provide necessary information such as company details, financial information, and references, ensuring all sections of the application form are complete and accurate.

What is the purpose of Ryder Commercial Credit Application?

The purpose of the Ryder Commercial Credit Application is to assess the creditworthiness of the applicant, enabling Ryder to determine the terms of credit and manage the financial risk involved in extending credit services.

What information must be reported on Ryder Commercial Credit Application?

Information that must be reported on the Ryder Commercial Credit Application includes the business name, address, contact information, tax identification number, financial statements, trade references, and any additional documentation required by Ryder.

Fill out your ryder financing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ryder Financing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.