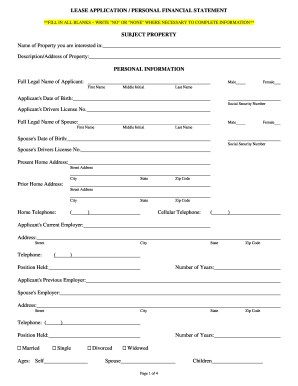

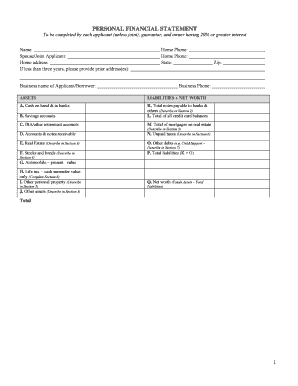

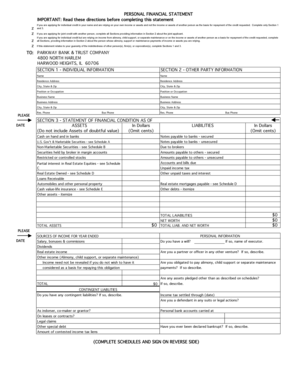

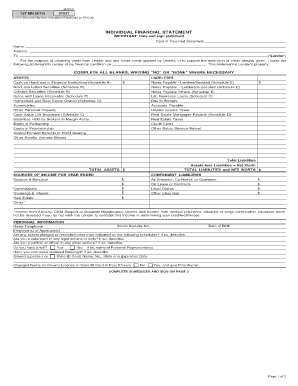

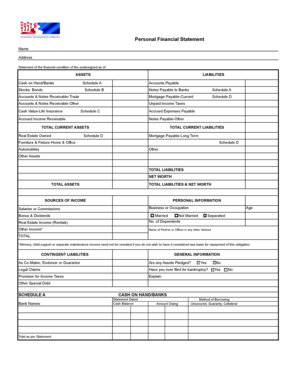

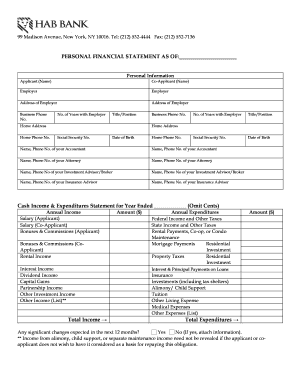

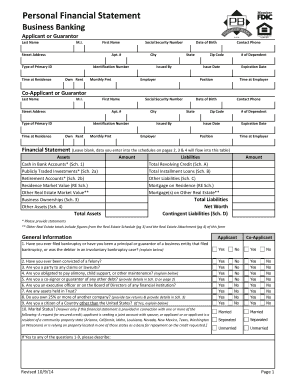

Personal Financial Statement Worksheet

What is personal financial statement worksheet?

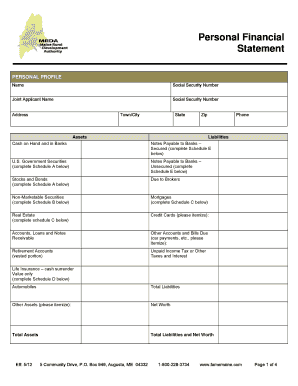

A personal financial statement worksheet is a document used to assess an individual's financial situation. It provides a detailed overview of their assets, liabilities, income, and expenses. This worksheet helps individuals track their financial progress, make informed decisions, and plan for the future.

What are the types of personal financial statement worksheet?

There are various types of personal financial statement worksheets available. Some common types include:

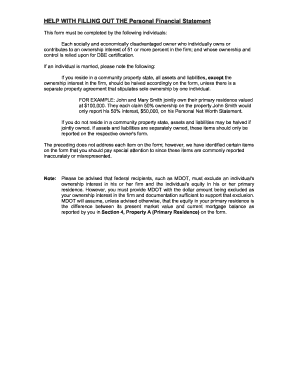

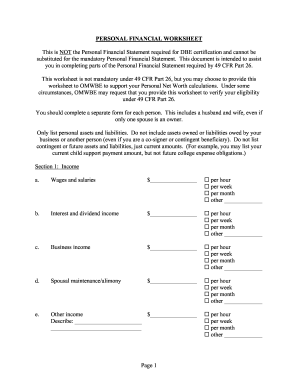

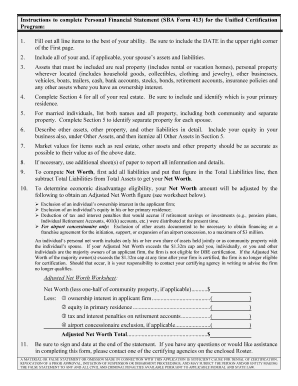

How to complete personal financial statement worksheet

Completing a personal financial statement worksheet is a simple process that can be done by following these steps:

By utilizing pdfFiller, users can conveniently create, edit, and share their personal financial statement worksheets online. With access to unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that can assist users in getting their financial documents done efficiently.