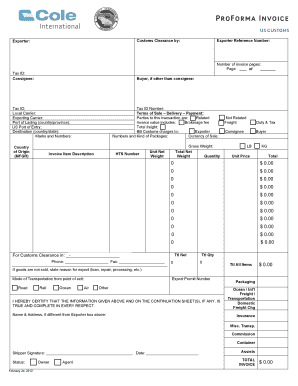

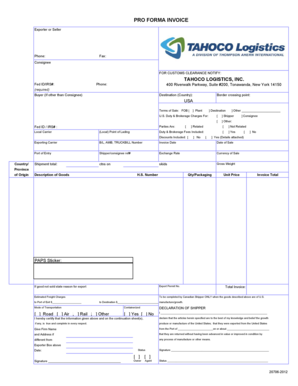

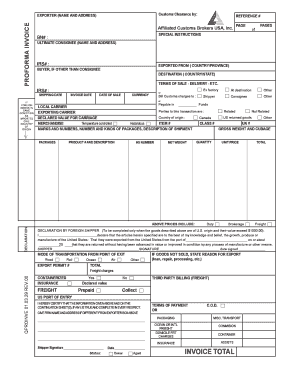

Proforma Invoice For Customs Clearance

What is proforma invoice for customs clearance?

A proforma invoice for customs clearance is a document sent by the seller to the buyer before the shipment of goods. It provides details about the goods, their value, and other necessary information for customs clearance purposes.

What are the types of proforma invoice for customs clearance?

There are two main types of proforma invoices for customs clearance: commercial proforma invoice and consular proforma invoice.

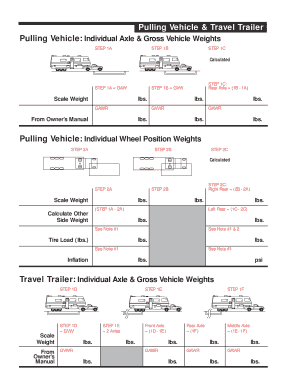

How to complete proforma invoice for customs clearance

Completing a proforma invoice for customs clearance is a straightforward process that involves providing accurate information about the goods being shipped and their value. Here are some steps to help you complete a proforma invoice:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.