Rev Proc 2014-11

What is rev proc 2014-11?

Rev Proc 2014-11, short for Revenue Procedure 2014-11, is a document issued by the Internal Revenue Service (IRS) that provides guidance on certain tax matters. It outlines specific procedures and requirements to be followed by taxpayers in certain situations. This revenue procedure serves as an essential resource for individuals and businesses, ensuring compliance with the tax laws and regulations set forth by the IRS.

What are the types of rev proc 2014-11?

Rev Proc 2014-11 covers various types of tax matters. Some of the key types addressed in this revenue procedure include:

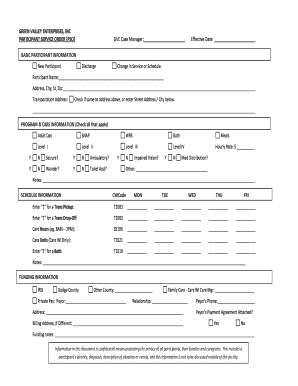

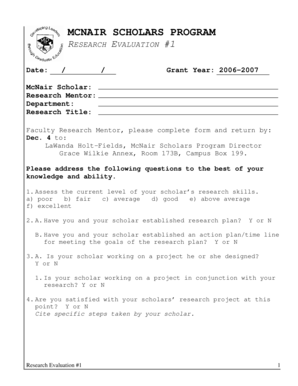

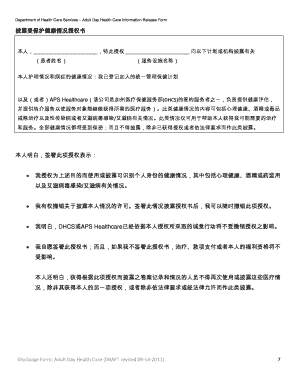

How to complete rev proc 2014-11

Completing rev proc 2014-11 involves following a set of steps to ensure compliance with the IRS guidelines. Here is a simplified guide to completing rev proc 2014-11:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.