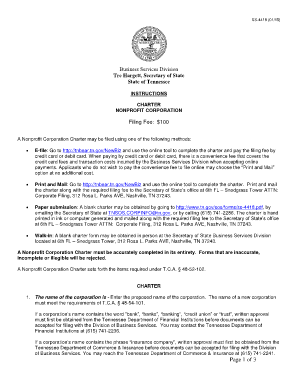

Form 1023 Filing Fee

What is form 1023 filing fee?

The form 1023 filing fee refers to the fee that organizations need to pay when submitting Form 1023, also known as the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. This form is required for organizations seeking tax-exempt status from the IRS.

What are the types of form 1023 filing fee?

There are two types of form 1023 filing fees based on the organization's projected gross receipts over a four-year period. The first type is for organizations with projected gross receipts of $10,000 or less, which requires a filing fee of $275. The second type is for organizations with projected gross receipts of more than $10,000, which requires a filing fee of $600.

How to complete form 1023 filing fee

Completing form 1023 filing fee requires careful attention to detail. Here are the steps you need to follow: 1. Gather all necessary information and documentation, including the organization's financial statements and bylaws. 2. Fill out the form accurately, providing all required information about the organization, its activities, and its finances. 3. Calculate the correct filing fee based on the projected gross receipts. 4. Double-check all the information provided and make sure it is accurate and up-to-date. 5. Pay the filing fee using the preferred payment method specified by the IRS. 6. Submit the completed form and fee to the appropriate IRS address, as instructed in the form's guidelines.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.