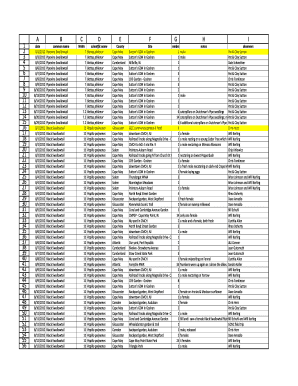

Balance Sheet Example Excel

What is Balance Sheet Example Excel?

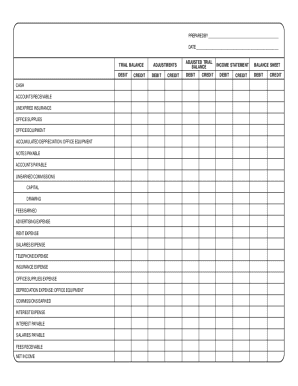

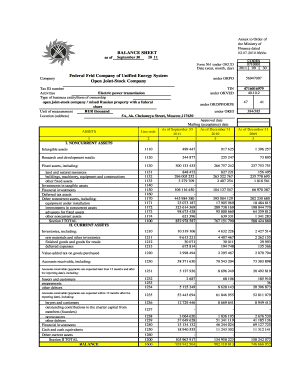

A balance sheet example in Excel is a financial statement that provides a snapshot of a company's financial standing, showing its assets, liabilities, and equity at a specific point in time. It is prepared using Microsoft Excel software and is commonly used by businesses to assess their financial health and make informed decisions.

What are the types of Balance Sheet Example Excel?

There are two main types of balance sheet examples in Excel:

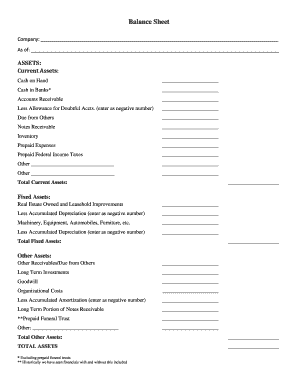

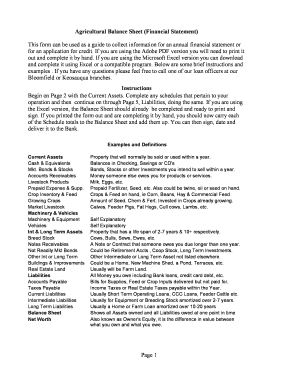

Classified Balance Sheet: This type of balance sheet organizes assets, liabilities, and equity into current and non-current categories. It provides a clearer picture of a company's short-term and long-term financial obligations.

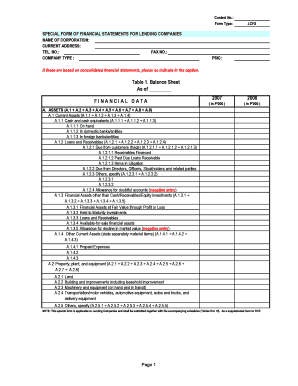

Comparative Balance Sheet: This type of balance sheet compares the financial position of a company across multiple periods, such as comparing the current year's balance sheet with the previous year's. It helps in analyzing trends and identifying changes in financial stability.

How to complete Balance Sheet Example Excel

To complete a balance sheet example in Excel, follow these steps:

01

Open Microsoft Excel and create a new spreadsheet.

02

Set up the layout of your balance sheet by creating separate columns for assets, liabilities, and equity.

03

Enter the relevant data in each column, starting with the assets section, followed by liabilities and equity.

04

Calculate the total values for each section and properly format the numbers.

05

Review the completed balance sheet for accuracy and make any necessary adjustments.

06

Save the balance sheet example in Excel format for future reference.

pdfFiller empowers users to create, edit, and share documents online. By offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done efficiently and effortlessly.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a balance sheet and what is it's purpose?

A balance sheet gives you a snapshot of your company's financial position at a given point in time. Along with an income statement and a cash flow statement, a balance sheet can help business owners evaluate their company's financial standing.

What is a balance sheet template?

Empower your business finances with a balance sheet template that shows year-to-year comparisons, increases or decreases in net worth, assets and liabilities, and more. Determine equity and make more informed business decisions.

What are the 4 parts of a balance sheet?

Balance Sheet Example As you will see, it starts with current assets, then non-current assets, and total assets. Below that are liabilities and stockholders' equity, which includes current liabilities, non-current liabilities, and finally shareholders' equity.

What is a balance sheet for beginners?

A balance sheet equation shows what a company owns (assets), how much it owes (liabilities), and how much stake or shares owners have in the business (shareholder's equity). You can calculate it using the following accounting formula: Assets = Liabilities + Shareholders' Equity.

What are the examples of balance sheet?

Example balance sheet assets – including cash, stock, equipment, money owed to business, goodwill. liabilities – including loans, credit card debts, tax liabilities, money owed to suppliers. owner's equity – the amount left after liabilities are deducted from assets.

How do you layout a balance sheet?

How to Prepare a Basic Balance Sheet Determine the Reporting Date and Period. Identify Your Assets. Identify Your Liabilities. Calculate Shareholders' Equity. Add Total Liabilities to Total Shareholders' Equity and Compare to Assets.

Related templates