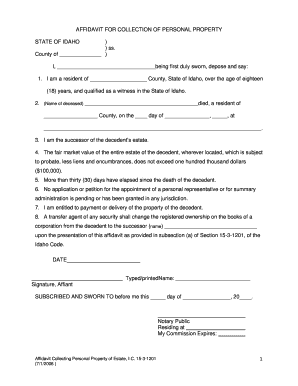

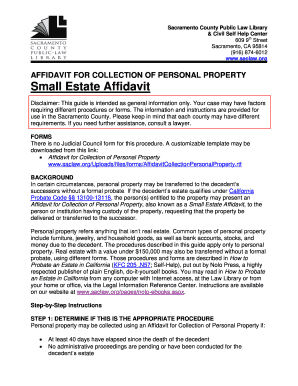

California Affidavit For Collection Of Personal Property

What is California Affidavit For Collection Of Personal Property?

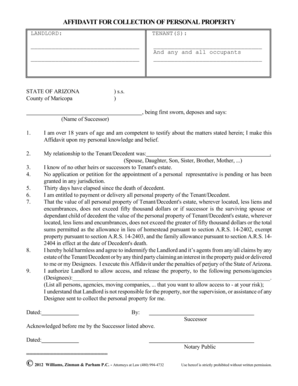

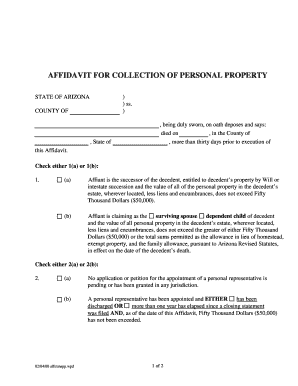

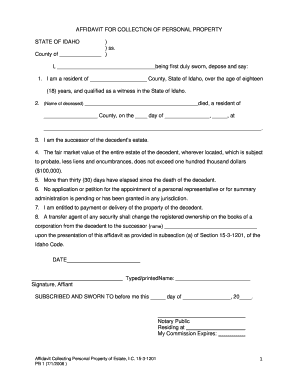

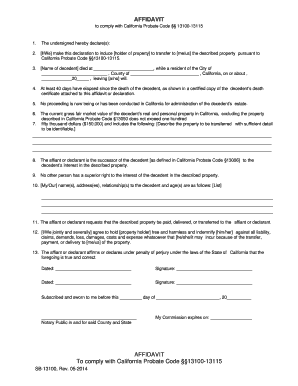

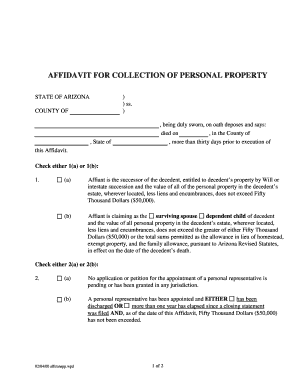

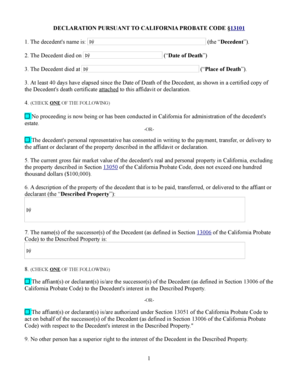

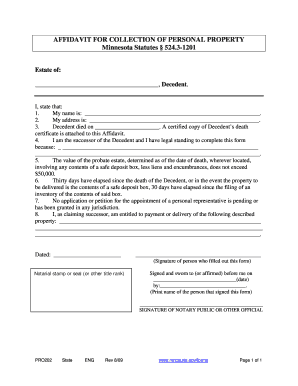

The California Affidavit For Collection Of Personal Property is a legal document used by heirs or beneficiaries to legally claim personal property belonging to a deceased individual. It is often required by financial institutions, government agencies, or creditors to transfer assets to the rightful heirs.

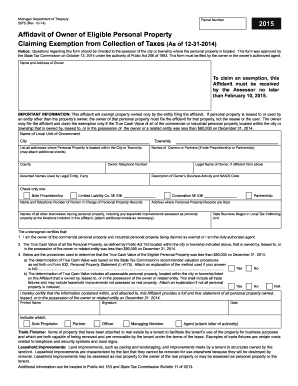

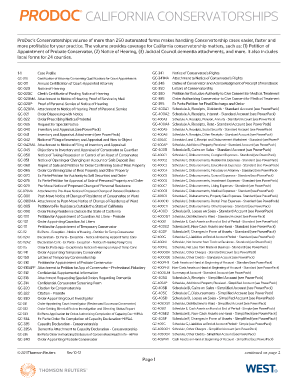

What are the types of California Affidavit For Collection Of Personal Property?

There are two main types of California Affidavit For Collection Of Personal Property: Affidavit for Collection of Personal Property Worth $150,000 or Less, and Affidavit for Collection of Personal Property Worth More Than $150,000. Each type is used depending on the total value of the deceased individual's assets.

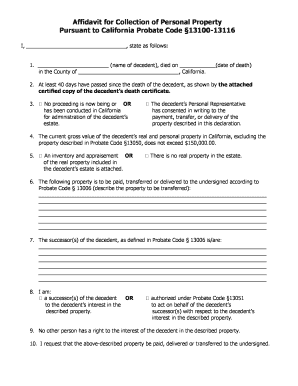

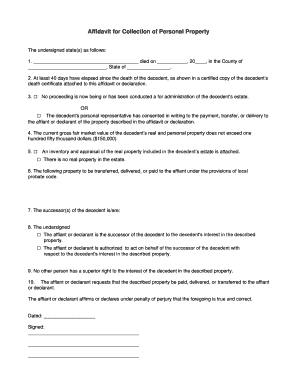

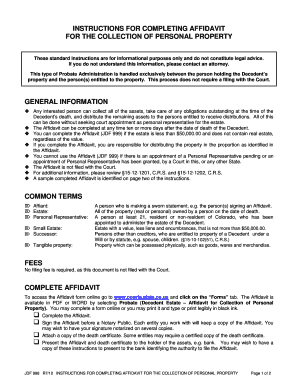

How to complete California Affidavit For Collection Of Personal Property

To complete the California Affidavit For Collection Of Personal Property, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.