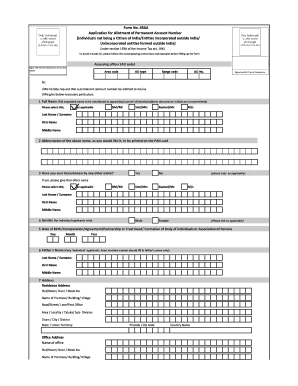

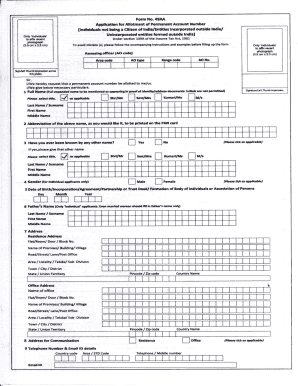

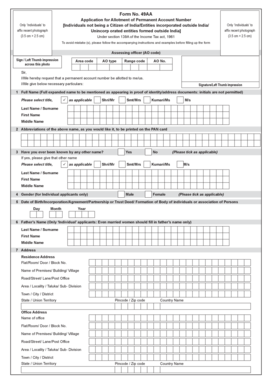

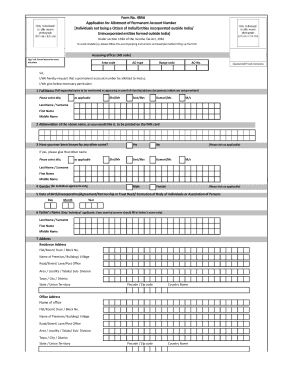

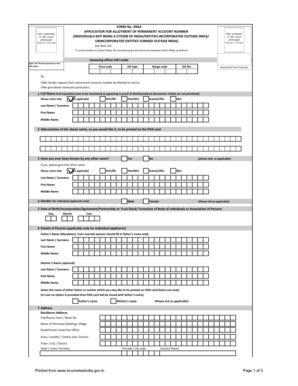

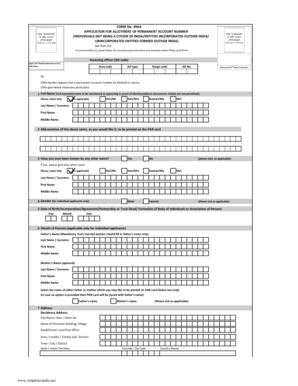

Form 49aa

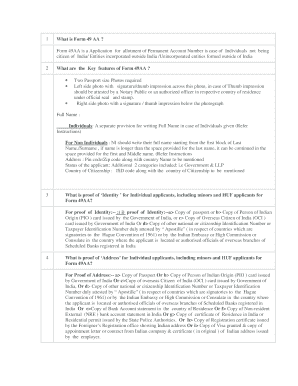

What is form 49aa?

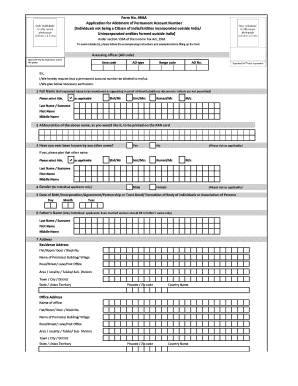

Form 49aa is a unique identification number issued by the Indian government to individuals who are not citizens of India but wish to make financial transactions within the country. This form serves as a means to track and record such transactions for taxation and regulatory purposes.

What are the types of form 49aa?

There are different types of form 49aa that cater to various categories of individuals based on their eligibility and purpose. These include:

How to complete form 49aa

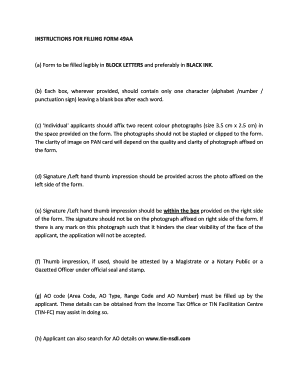

Completing form 49aa is a straightforward process. Follow these steps to ensure accurate and efficient completion:

To simplify the form filling process, you can rely on pdfFiller. With its user-friendly interface and a wide range of features, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.