Opening Day Balance Sheet - Page 2

What is Opening Day Balance Sheet?

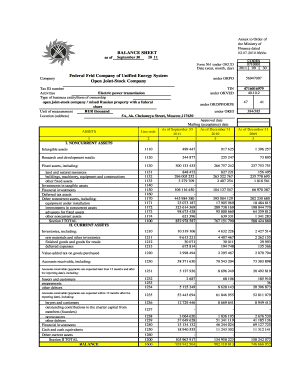

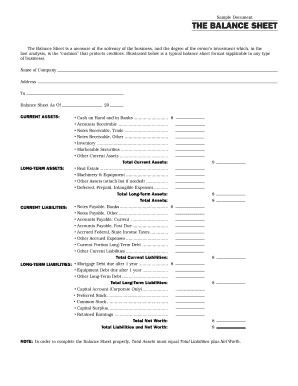

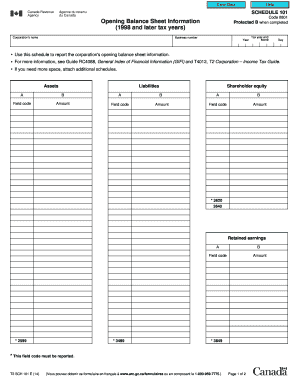

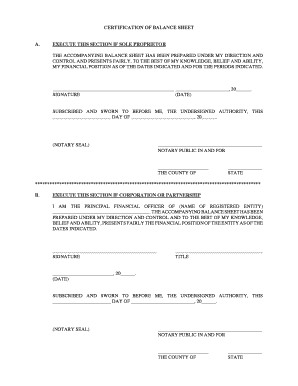

An Opening Day Balance Sheet is a financial statement that provides a snapshot of a company's financial position at the beginning of a new accounting period. It includes the company's assets, liabilities, and owner's equity. The purpose of the Opening Day Balance Sheet is to give a clear picture of the company's financial status and is an essential tool for financial analysis and decision-making.

What are the types of Opening Day Balance Sheet?

There are two main types of Opening Day Balance Sheet: comparative balance sheet and classified balance sheet. 1. Comparative Balance Sheet: This type of balance sheet compares the current period's financial position with the previous period's financial position. It helps in analyzing the changes in assets, liabilities, and equity over time. 2. Classified Balance Sheet: A classified balance sheet categorizes assets, liabilities, and equity into current and non-current categories. It provides a more detailed view of the company's financial position and helps in assessing liquidity and solvency.

How to complete Opening Day Balance Sheet

Completing an Opening Day Balance Sheet involves several steps: 1. Gather financial documents: Collect the necessary financial statements, including income statements, cash flow statements, and previous balance sheets. 2. List assets: Record all the company's assets, such as cash, accounts receivable, inventory, and property. Include the value and classification of each asset. 3. Calculate liabilities: List all the company's liabilities, including accounts payable, loans, and other debts. Assign a value and classification to each liability. 4. Determine owner's equity: Calculate the owner's equity by subtracting the total liabilities from the total assets. 5. Prepare supporting schedules: If needed, create supporting schedules for more detailed information about specific asset or liability accounts. 6. Review and analyze: Double-check all the information, reconcile any discrepancies, and analyze the financial position of the company. 7. Communicate findings: Present the Opening Day Balance Sheet to stakeholders, such as investors, creditors, and management, to facilitate decision-making and financial planning.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.