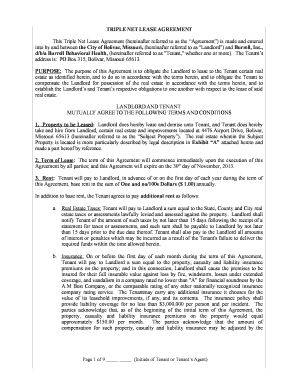

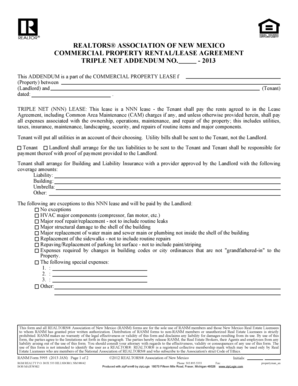

Triple Net Lease Properties

What is triple net lease properties?

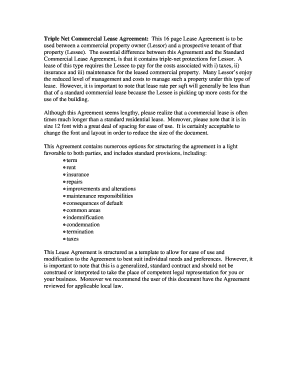

Triple net lease properties, also known as NNN properties, are a type of commercial real estate lease where tenants are responsible for paying additional expenses on top of the base rent. These additional expenses typically include property taxes, insurance, and maintenance costs. In other words, the tenant is responsible for not only paying rent but also covering the ongoing expenses associated with the property. This type of lease structure is commonly used in commercial real estate transactions.

What are the types of triple net lease properties?

There are several types of triple net lease properties that tenants can consider: 1. Single-Tenant Properties: These are commercial properties occupied by a single tenant. 2. Multi-Tenant Properties: These are commercial properties with multiple tenants and each tenant is responsible for their share of expenses. 3. Sale-Leaseback Transactions: In this type of arrangement, a property owner sells their property and then leases it back from the buyer, becoming a tenant. 4. Ground Leases: These involve leasing the land only, and the tenant is responsible for constructing and maintaining the buildings on the leased land.

How to complete triple net lease properties

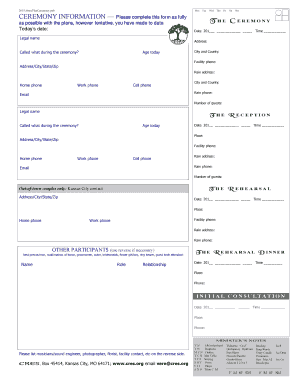

Completing triple net lease properties involves the following steps: 1. Find a suitable property: Start by identifying commercial properties that align with your business needs and budget. 2. Research the property: Thoroughly analyze the property's location, condition, and potential for future growth. 3. Negotiate lease terms: Work with the property owner or their representative to negotiate favorable lease terms, including rent amount, lease duration, and responsibilities for additional expenses. 4. Seek legal advice: Consult with a real estate attorney to review the lease agreement and ensure that your rights and interests are protected. 5. Sign the lease agreement: Once all terms are agreed upon, sign the lease agreement and make any required initial payments.

pdfFiller can empower you to complete triple net lease properties with ease. With its unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor you need to efficiently handle your lease documents. Get started today and streamline your leasing process!