Deposit Footnote Accreditation Gratis

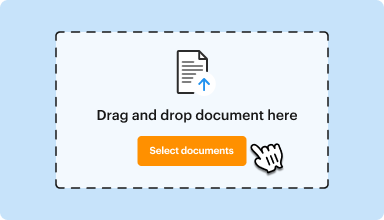

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

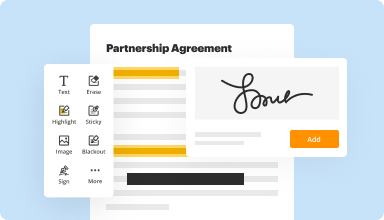

Fill out, edit, or eSign your PDF hassle-free

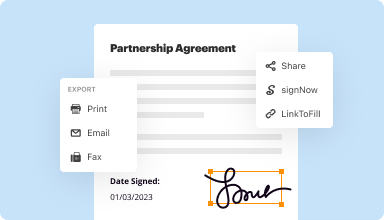

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

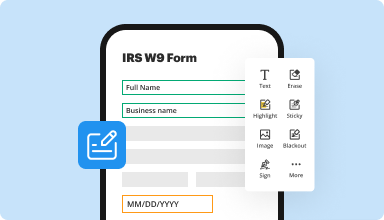

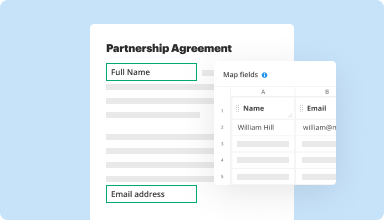

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

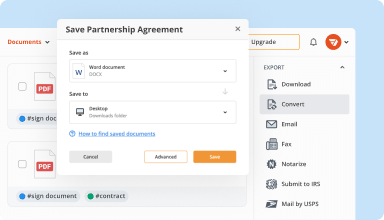

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

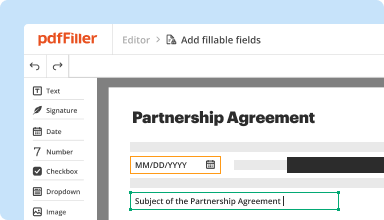

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

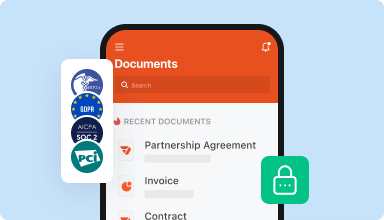

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Everything is at my hand. As I have been out of legal arena for over 10 years, I am confident the form I am filling suggests accurate info on which document to use next.

2016-09-27

I needed on copy of a form, that is all and I was charged 120.00, that is an expensive copy. I have cancelled your service and would appreciate a full refund. Charge me for one copy fine, but not 120.00. Thank you

2017-07-14

Easy to use, great feedback. Only wish there were more features built in. I've given feedback on how adding field to a form should have built in guides that you can place, then drop and snap to. Another great feature would be to allow these fields to move with the arrow keys so when you don't want it to snap to position, you can manually adjust to make exact. Also, it would be nice to see the text fields with faded text so we can see how many letters we can fit without having to save and test it ourselves. I could probably give more feedback but maybe I should send in my job application first? lol

2019-10-29

After some heartbreak at having lost the doc I was working on, the team at pdffiller managed to retrieve it for me. All those tears later, I am ecstatic to have my hard work not be for nothing!

2020-03-08

A safe way to fill forms

I wish they had an option for screenshare set up support. Though it took awhile to learn, we are so grateful for what it's allowed our company to do!

LinktoFill allows us to send out one link and receive back filled PDF's instead of uploading over and over and sending back and forth to gather missed info.

The site is hard to learn and takes a bit to get used to.

2019-05-30

It is easy, so relax and just do what you need to do.

I am so very, very pleased with how easy the program is to use. I tried others for this emergency situation and was frustrated out of my mind with the complicated programs. This one is easy, easy and very effective.

2023-10-15

i was not happy with the Basic Plan being advertised for $8 per month and then subscribing and it suddenly being $20. I looked at some past notes from Sept. 2020 in my computer and it looks like I joined in Sept. 2020 and discovered the pricing being different than advertised, and I canceled then. Today I needed to sign some project documents and rejoined rather than playing around with a free trial of DocuSign that didn't offer what I wanted for variety in signatures etc. Giving PDF Filler a try. Will call CS to hear what their explanation is regarding what you advertise for $8 per month, only to see it is really $20. Evelyn Basile, Chicago

2022-02-14

I need fast turnarounds for information as I do not have time to convert content from other platforms. I have little time and money to do things. The PDF filler is cost effective and enables me to convert content in a matter of seconds, rather than hours in some cases.

2022-01-20

This is a life changer

This is a life changer! didn't even realise it was possible to directly type into PDF forms, this has made things so much easier!

2020-09-20

Deposit Footnote Accreditation Feature

The Deposit Footnote Accreditation feature enhances your deposit processing experience by adding clarity and compliance. This tool helps you maintain transparency and improves communication with your clients.

Key Features

Customizable footnotes for specific deposits

Automated footnote inclusion in transaction records

Real-time updates and notifications for deposits

Enhanced compliance tracking and reporting

Potential Use Cases and Benefits

Financial institutions looking to improve client communication

Businesses needing clear documentation for audit purposes

Organizations aiming for better compliance with regulations

Clients who want more information on their deposit transactions

By implementing the Deposit Footnote Accreditation feature, you can address common challenges in deposit tracking and enhance the user experience for your clients. This tool provides clarity, reduces confusion, and builds trust, allowing you to focus on what matters most: your business growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is a certificate of deposit and how does it work?

Certificates of deposit are a secure form of time deposit, where money must stay in the bank for a certain length of time to earn a promised return. A CD, also called a share certificate at credit unions, almost always earns more interest than a regular savings account.

What do you mean by certificate of deposits?

A certificate of deposit (CD) is a time deposit, a financial product commonly sold by banks, thrift institutions, and credit unions. CDs are similar to savings accounts in that they are insured “money in the bank” and thus virtually risk-free.

What is an example of a certificate of deposit?

Certificate of Deposits (CDs) Money Market Account. Auto Loans. Personal Loans. Student Loans.

WHO issues certificate deposit?

Eligibility for Certificate of Deposit: Certificates of Deposit are issued by scheduled commercial banks and select financial institutions in India as allowed by RBI within a limit. Certificates of Deposits are issued to individuals, companies, corporations and funds among others.

Are certificates of deposits worth it?

CDs are seen as safe bets for saving or investing since they are federally insured and returns are guaranteed. And when CD rates go up, as they have in the past year, you'll earn more money. ... But locking up funds in CDs for months or years isn't the best move for everyone.

Do CDs pay interest monthly?

A CD's APY depends on the frequency of compounding and the interest rate. ... Generally, CDs compound on a daily or monthly basis. DO CDs PAY DAILY, MONTHLY, OR YEARLY. The answer varies by account, but most CDs credit interest monthly.

How often do CDs earn interest?

These come with regularly scheduled interest rate increases, so you're not locked into the rate that was in place at the time you bought your CD. Increases might come every six months, every nine months, or in the case of long-term CDs, once a year.

Do certificate of deposits pay monthly?

Definition: A certificate of deposit, or CD, is a type of federally insured savings account that has a fixed interest rate and fixed date of withdrawal, known as the maturity date. CDs also typically don't have monthly fees.

How does a CD pay interest?

Like savings accounts, CDs earn compound interest meaning that periodically, the interest you earn is added to your principal. Then that new total amount earns interest of its own, and so on.

Are CD's worth it?

CDs are seen as safe bets for saving or investing since they are federally insured and returns are guaranteed. And when CD rates go up, as they have in the past year, you'll earn more money. ... But locking up funds in CDs for months or years isn't the best move for everyone.

Video Review on How to Deposit Footnote Accreditation

#1 usability according to G2

Try the PDF solution that respects your time.