Online Taxes Esign PDF shortcut alternative

Use pdfFiller instead of Online Taxes to fill out forms and edit PDF documents online. Get a comprehensive PDF toolkit at the most competitive price.

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

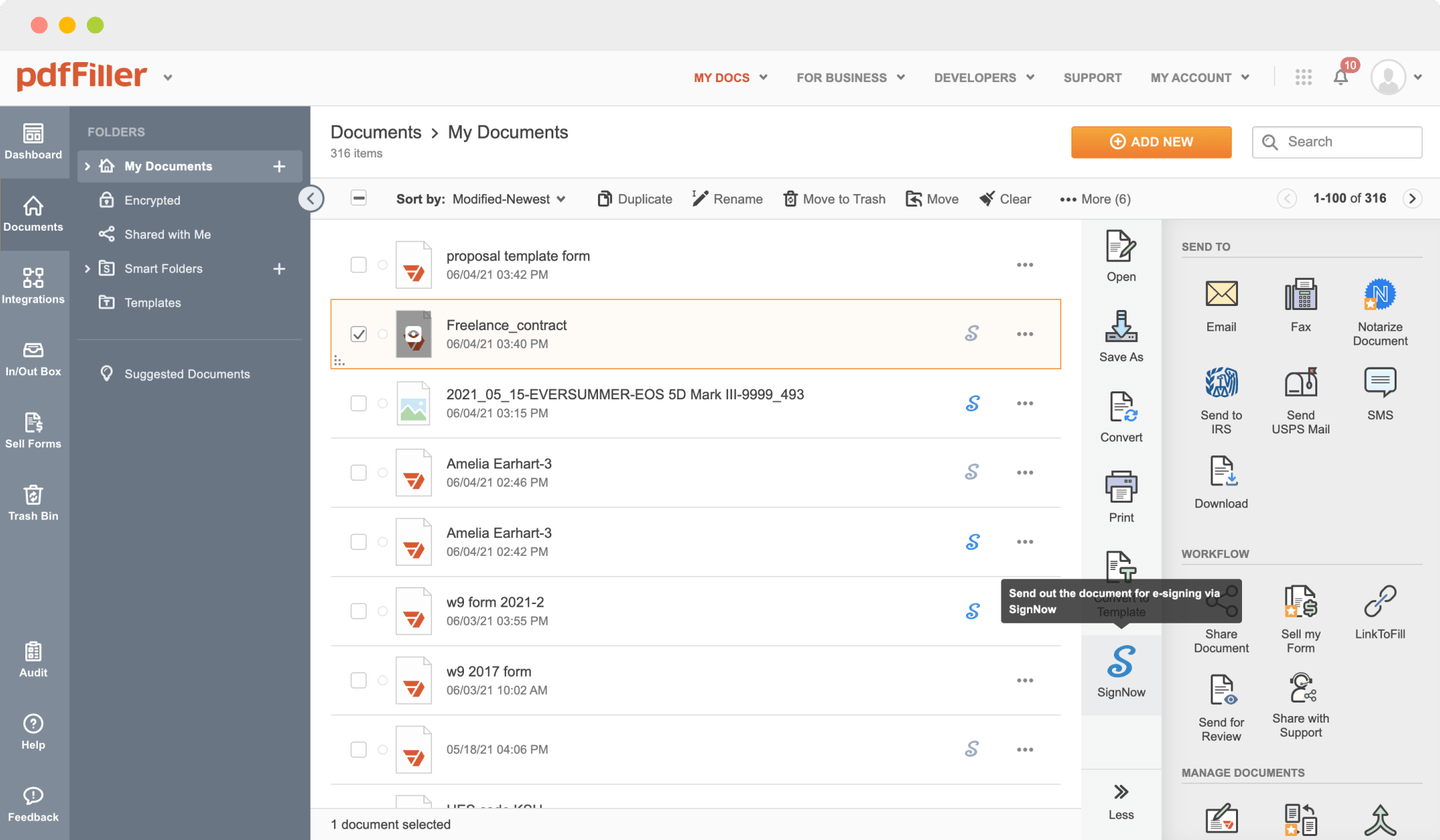

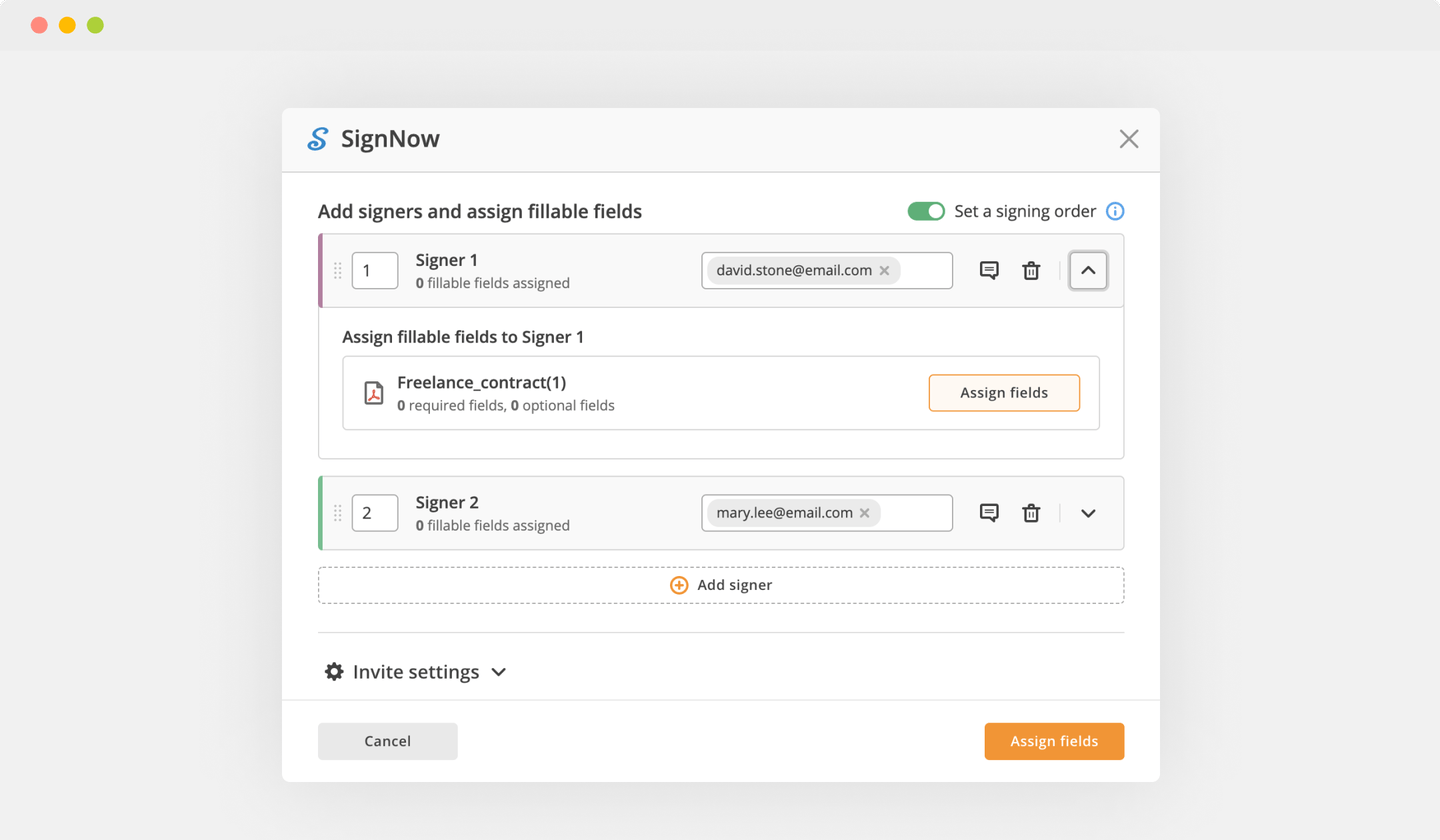

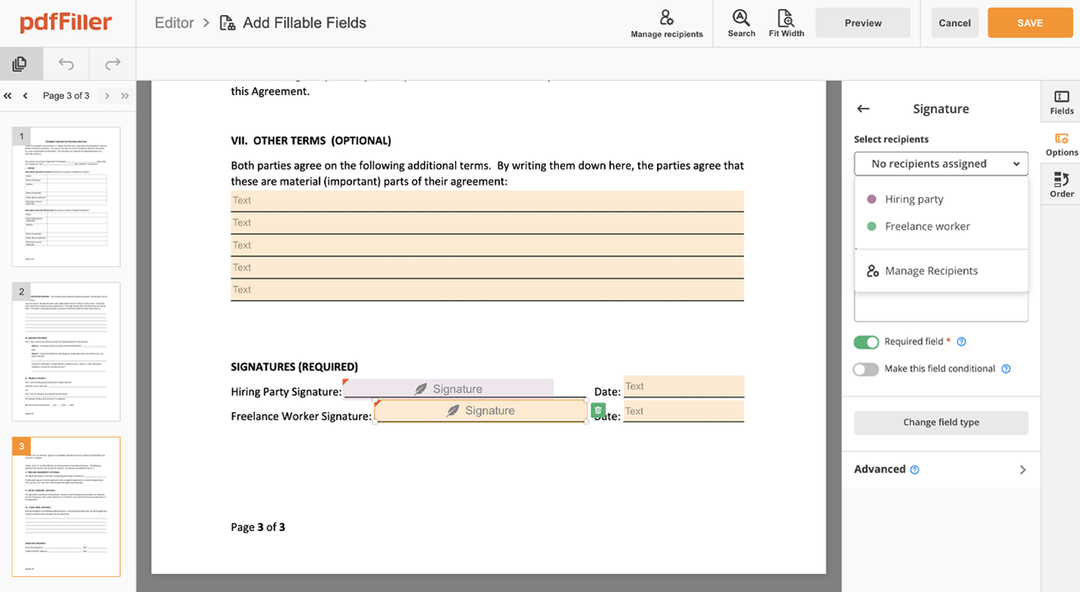

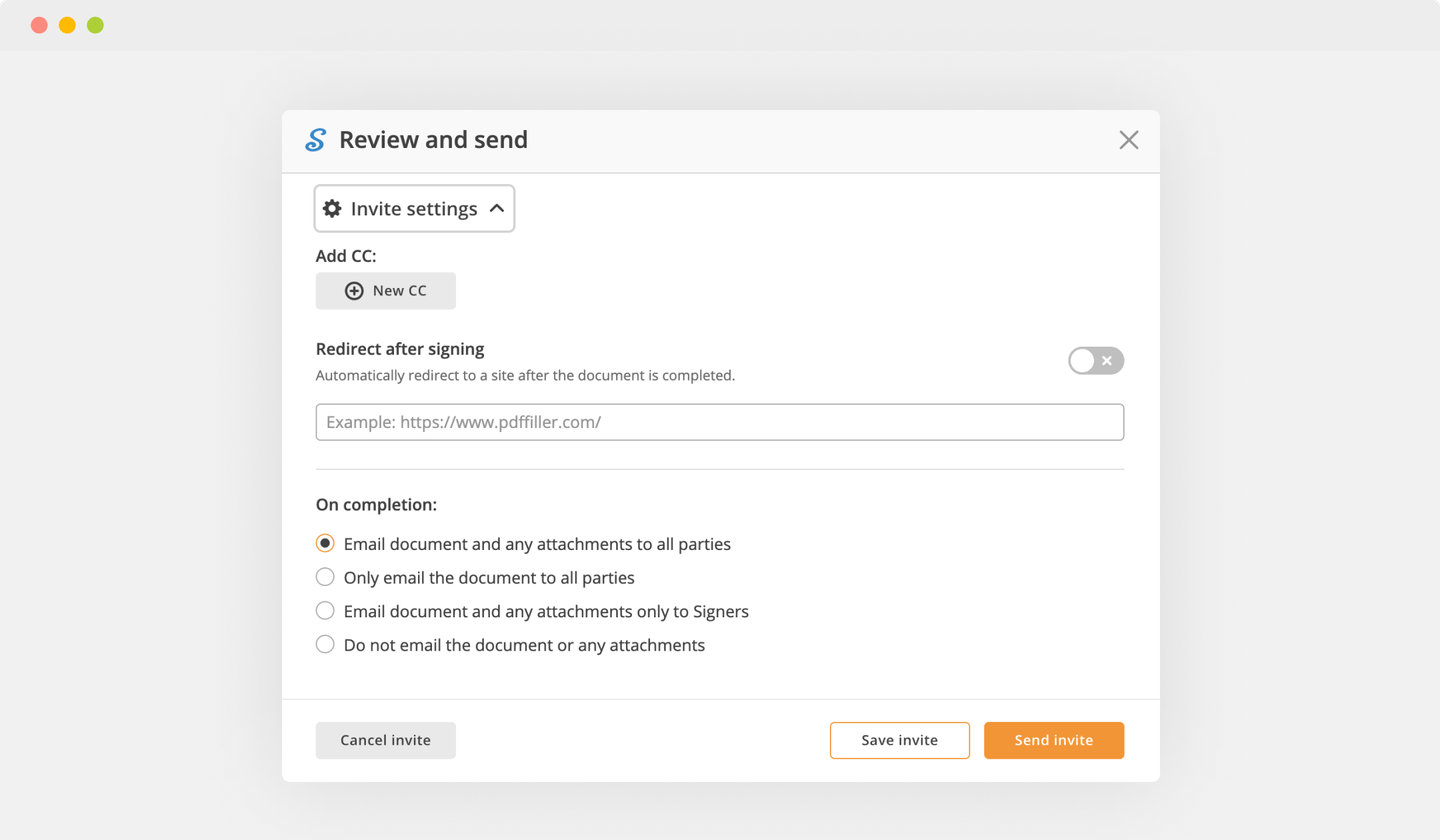

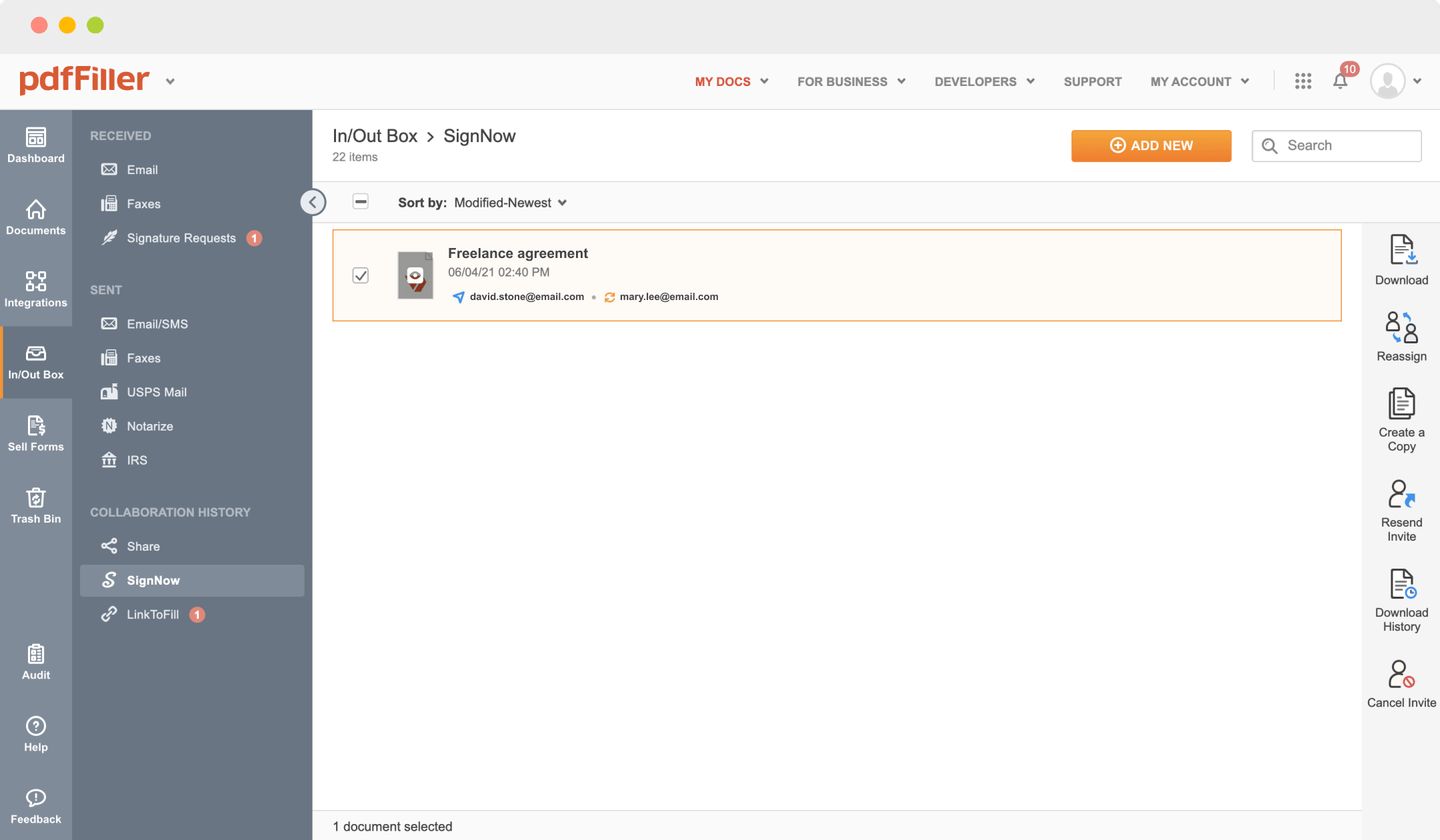

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

How to Online Taxes Esign PDF shortcut alternative - video instructions

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Consultant in Non-Profit Organization Management

2019-05-28

Jonathan Amodu

2019-04-16

My name is Jonathan from Africa

My name is Jonathan from Africa, I needed a form via PDFfiller but was unable to use the service and was billed while on 30 days trial. That got me upset but after contacting Shennon online support, I was assisted, and in less than 10 minutes, it was resolved. Shennon exceeded my expectation. Satisfied. Therefore I commend Shennon for a great and wow customer service. Because of this singular act, I will recommend your company to friends.Thank you

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

pdfFiller scores top ratings in multiple categories on G2

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can IRS forms be signed electronically?

11, 2020, the IRS extended the period during which it will accept a number of forms for which it will temporarily allow required signatures in electronic or digital form. The original authorization was from Aug. 28 through Dec. 31, 2020.

Can you design tax return?

You can sign your tax return electronically by using a Self-Select PIN, which serves as your digital signature when using tax preparation software, or a Practitioner PIN when using an Electronic Return Originator (ERO). If you're filing a joint return, each spouse uses his or her own PIN.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.

I love the program as a homeless case manager, I can review information with clients, send to them for review, and signature from my office

What do you dislike?

It needs a desktop application for easier access vs going to the website all the time.

What problems are you solving with the product? What benefits have you realized?

decreasing my travel, having access to documents when I need them in the PDF website, and access to cloud networks