Additional Taxes on Qualified Plans (Including IRAs) and Other...

Purchase the Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts forms package to get these templates

Try pdfFiller’s Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts forms package to fill out and send entire document groups simultaneously. Now you have all templates you need available, so you finally can save time on searching and sorting documents. You can also opt out the forms you don't need from the bundle, to cut the costs even more.

Forms from the pdfFiller bundles are carefully picked to match every particular case. You can find packages by category, ensure you get the documents you need, and proceed to the completion procedure. pdfFiller provides you with a robust document editing tool, legally-binding e-signatures, and complies with industry-leading standards for data protection.

To start editing the template, click the Fill Now button. Enter the information in the fillable fields marked as required. Use the Wizard tool so you don’t miss any important sections. It highlights the required fields one after another, cueing the information you should add. Also, take advantage of the field list to make sure that all of them are completed. Repeat the same procedure with each form in the Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts package and send them out simultaneously.

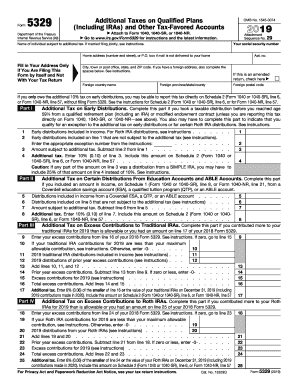

IRS Form 5329 Form 5329, entitled "Additional Taxes on Qualified Retirement Plans (including IRAs) and Other Tax-Favored Accounts," is filed when an individual with a retirement plan or ESA needs to indicate whether they owe the IRS the 10% early-distribution or another penalty.

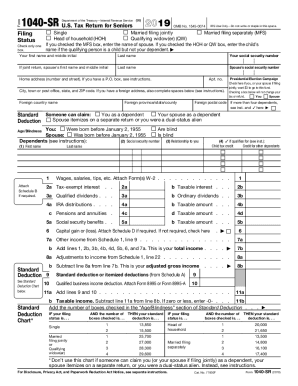

Form 1040NR is a version of the IRS income tax return that nonresident aliens may have to file if they engaged in business in the United States during the tax year or otherwise earned income from U.S. sources throughout the year.

Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts FAQs