File Taxes Forms Package

The templates you get with the File Taxes forms package

Get your paperwork done faster by managing documents in groups. Get the File Taxes package to simplify the process of submitting these forms, doing them simultaneously.

Forget about searching for the document or application you need. Within pdfFiller, templates are categorized and organized into packages. The File Taxes package, like other bundles available, offers a pack of templates you can submit and send unlimited number of times. Conveniently change the structure of your document and edit its content. There are various personalizing features available, all of them sorted into separate toolbars according to the cases they serve. Once finished, click Done and now you're ready to send the forms out.

The File Taxes package, as well as the many other form packages by pdfFiller, allows you to find, complete, and send required documents in no time, thanks to convenient search and categorizing. Special template packages like the one listed above will come in use for you when you need to file various documents for a particular occasion, as fast as possible. Save your time, streamline your workflow, and submit important files as effectively and efficiently as possible.

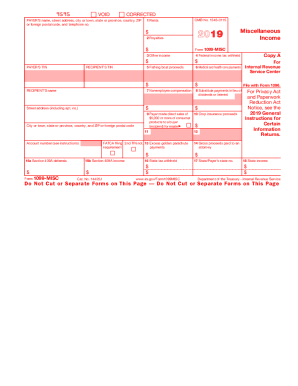

File this form to report gambling winnings and any federal income tax withheld on those winnings. ... the type of gambling, the amount of the gambling winnings, and. generally the ratio of the winnings to the wager.

File Taxes Forms Package FAQs