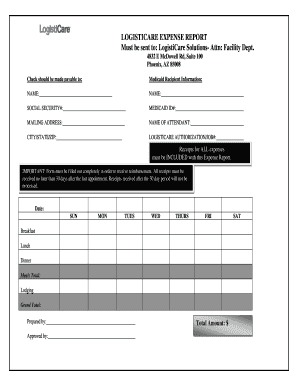

Expense Report Form

What is Expense Report Form?

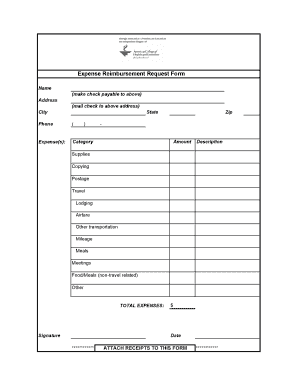

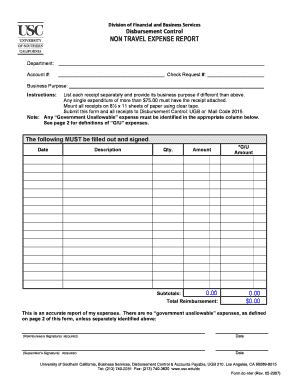

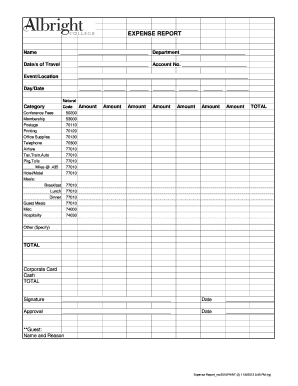

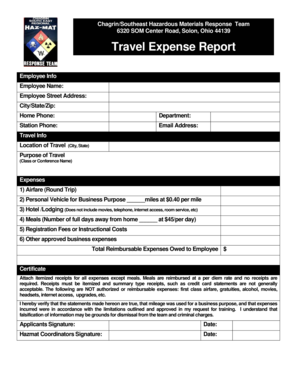

An Expense Report Form is a document used to track and record expenses incurred by an individual or a company. It helps in keeping a detailed record of all the expenses, which can later be used for reimbursement or for tax purposes.

What are the types of Expense Report Form?

Expense Report Forms come in different types to cater to various needs. Some common types of Expense Report Forms include:

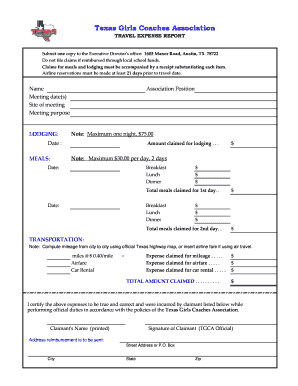

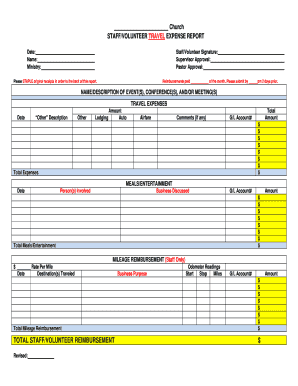

Mileage Expense Report Form

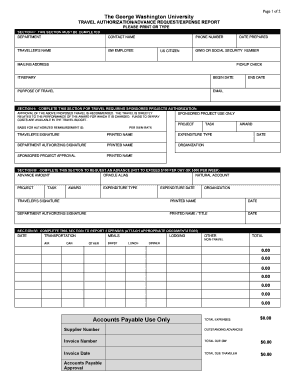

Travel Expense Report Form

Meal Expense Report Form

Entertainment Expense Report Form

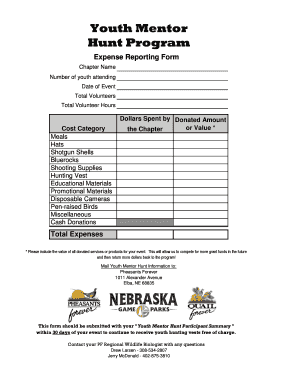

Miscellaneous Expense Report Form

How to complete Expense Report Form

Completing an Expense Report Form is a simple process. Here are the steps to follow:

01

Gather all relevant receipts and documents related to the expenses.

02

Enter personal or company information in the designated fields.

03

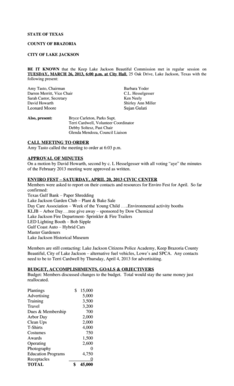

List each expense separately, providing details such as date, amount, and category.

04

Attach scanned or digital copies of receipts as supporting documents.

05

Calculate the total amount and double-check for accuracy.

06

Submit the completed Expense Report Form for approval and reimbursement if applicable.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Expense Report Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create an expense sheet in Word?

Search “expense” in the search bar. Press “Enter” to show the available template and then click the result. A new window will appear, giving you the template name and description along with a preview of the template. Click “Create.”

How do I do an expense report in Excel?

Using the Expense Report Template in Excel: For each expense, enter the date and description. Use the dropdown menus to select payment type and category for each expense. For each expense, enter the total cost. Attach all necessary receipts to the document. Submit for review and approval!

How do I create an expense report in Word?

0:00 0:40 How to Create an Expense Report in Microsoft Word 2010 - YouTube YouTube Start of suggested clip End of suggested clip Using templates the first thing you're going to do is click on file. Next you'll select new. If youMoreUsing templates the first thing you're going to do is click on file. Next you'll select new. If you take a look over to the right where it says office comm templates what you're going to do next is.

How do you fill out an expense report?

How to create an expense report: 9 easy steps Name, department, and contact information. List of itemized expense names. Date of purchase for each item. Receipts. Total amount spent. Purpose of the expense. Actual cost of item (subtraction of discounts) Repayment amount sought.

What receipts are required for expense reports?

The IRS requires businesses to keep receipts for all business expenses of $75 and up. Note that if your business is audited, you'll still need to be able to provide basic information about expenses under $75, such as the date of the purchase and its business purpose.

How do I make an expense report?

How Do You Create an Expense Sheet? Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.

Related templates