Form 407 Finra - Page 2

What is form 407 finra?

Form 407 finra is an important document that needs to be filled out in certain financial situations. It is a form that is used by the Financial Industry Regulatory Authority (FINRA) to gather information and maintain records of various financial transactions. This form helps to ensure compliance with regulatory requirements and promotes transparency in the financial industry.

What are the types of form 407 finra?

There are different types of form 407 finra, each designed for specific financial activities. Some of the commonly used types include: 1. Form 407-A: Used for reporting acquisitions or mergers of member firms. 2. Form 407-B: Used for reporting changes in control or ownership of member firms. 3. Form 407-C: Used for reporting changes in a firm's executive officers or directors. 4. Form 407-D: Used for reporting changes in a firm's contact information. 5. Form 407-E: Used for reporting changes in a firm's business locations. These forms play a crucial role in ensuring that accurate and up-to-date information is recorded and maintained for regulatory purposes.

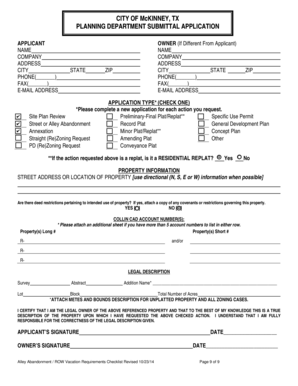

How to complete form 407 finra

Completing form 407 finra is a straightforward process that involves the following steps: 1. Obtain the correct form: Make sure you have the appropriate form for the specific financial activity you need to report. 2. Gather the required information: Collect all the necessary details and supporting documents related to the transaction. 3. Read the instructions: Carefully review the instructions provided with the form to understand the requirements and guidelines. 4. Fill out the form accurately: Enter the required information accurately, ensuring that all fields are correctly completed. 5. Double-check for errors: Review the filled form for any errors or omissions and make corrections as needed. 6. Submit the form: Once you have completed the form, submit it according to the specified submission method. By following these steps, you can efficiently complete form 407 finra and meet the necessary regulatory obligations.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.