Irrevocable Living Trust Agreement - Page 2

What is Irrevocable Living Trust Agreement?

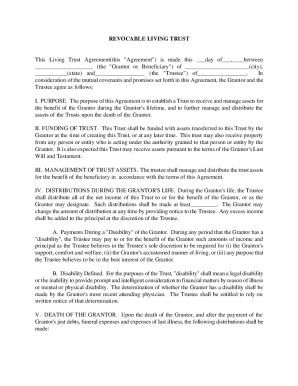

An Irrevocable Living Trust Agreement is a legal document that allows individuals to transfer their assets into a trust during their lifetime. This type of trust agreement cannot be altered or revoked once it is created, providing an added layer of protection and control over the distribution of assets.

What are the types of Irrevocable Living Trust Agreement?

There are several types of Irrevocable Living Trust Agreements that individuals can choose based on their specific needs and goals. Common types include: 1. Irrevocable Life Insurance Trust: This trust is designed to own life insurance policies outside the estate, ensuring that the proceeds are not subject to estate taxes. 2. Grantor Retained Annuity Trust: With this trust, the grantor retains the right to receive fixed annual payments for a specific period, after which the remaining assets pass to the beneficiaries. 3. Qualified Personal Residence Trust: This trust allows the grantor to transfer their primary residence or vacation home to the trust while retaining the right to live in it for a defined period. Upon expiration, the property is distributed to the beneficiaries. 4. Charitable Remainder Trust: By establishing this trust, individuals can donate assets to a charitable organization while retaining the right to receive income from those assets during their lifetime.

How to complete Irrevocable Living Trust Agreement

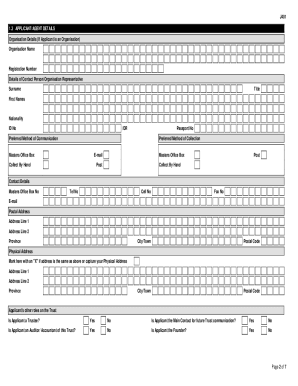

Completing an Irrevocable Living Trust Agreement can be a straightforward process when following these steps: 1. Gather necessary information: Collect all the essential details, such as the names of the grantor and beneficiaries, the assets to be included in the trust, and any specific instructions. 2. Consult an attorney: It is recommended to seek legal advice to ensure compliance with applicable laws and regulations while drafting the Irrevocable Living Trust Agreement. 3. Draft the trust agreement: With the guidance of your attorney, create the trust agreement by outlining the terms, conditions, and provisions that align with your objectives. 4. Review and revise: Carefully review the drafted agreement, making any necessary revisions to accurately reflect your intentions. 5. Execute the agreement: Sign the Irrevocable Living Trust Agreement in the presence of witnesses and notary public, as required by state laws. 6. Fund the trust: Transfer the selected assets into the trust according to the provisions outlined in the agreement.

pdfFiller, an industry-leading online platform, empowers users to create, edit, and share documents online with ease. With its vast collection of unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that users can confidently rely on to get their documents done efficiently and securely.