Japanese Chart

What is Japanese Chart?

Japanese Chart, also known as Ichimoku Kinko Hyo, is a popular technical analysis tool used in the financial markets. It was developed by Japanese journalist Goichi Hosoda in the late 1960s. The Japanese Chart provides a holistic view of price movement and helps traders identify trends, support and resistance levels, and potential reversal signals.

What are the types of Japanese Chart?

There are several types of Japanese Chart that traders can use to analyze price action. The most common types include: 1. Tenkan-Sen (Conversion Line): This calculates the average of the highest high and the lowest low over a specified period. 2. Kijun-Sen (Base Line): This calculates the average of the highest high and the lowest low over a longer period compared to the Tenkan-Sen. 3. Senkou Span A (Leading Span A): This represents the midpoint between the Tenkan-Sen and the Kijun-Sen, projected forward. 4. Senkou Span B (Leading Span B): This calculates the average of the highest high and the lowest low over an even longer period, projected forward. 5. Chikou Span (Lagging Span): This plots the closing price X periods behind on the chart. Each of these components provides valuable insights into market trends and can be used in combination to make more informed trading decisions.

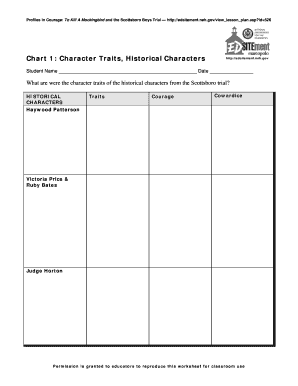

How to complete Japanese Chart

Completing a Japanese Chart requires a basic understanding of its components and how they interact. Here are the steps to complete a Japanese Chart:

With the help of powerful editing tools and unlimited fillable templates, pdfFiller empowers users to create, edit, and share documents online. Whether you need to fill out important forms or collaborate on a project, pdfFiller is the only PDF editor you need to get your documents done quickly and efficiently.