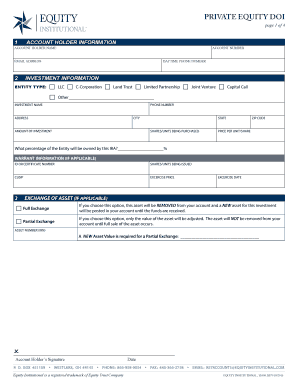

Private Equity Offering Memorandum Sample

What is private equity offering memorandum sample?

A private equity offering memorandum sample is a document that outlines the key information about a private equity offering. It provides details about the investment opportunity, the terms and conditions, and the risks involved. The sample serves as a template that can be used by companies to create their own offering memorandum for potential investors to review.

What are the types of private equity offering memorandum sample?

There are several types of private equity offering memorandum samples available. Some common types include:

How to complete private equity offering memorandum sample

Completing a private equity offering memorandum sample involves the following steps:

By using pdfFiller, you can easily create, edit, and share your private equity offering memorandum online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ideal PDF editor for getting your documents done efficiently.