Fill out a W-2C form online

When completing tax forms, errors can happen. If you failed to provide the correct information in a W-2 form you have already submitted, filing a W-2C will allow you to make needed corrections. With pdfFiller, filling out and managing tax forms is easier than ever.

This page is for informative purposes only and does not constitute tax or legal advice

What is a W-2C form?

W-2C is a standard form for corrected wage and tax statements. Just like a W-2,

it is prepared by an employer and filed with the Social Security Administration (SSA)

if the information reported in the original W-2 contained errors, e. g., an incorrect

employee’s name or SSN, wrong dollar amounts, etc.

You must file a W-2C form ONLY if you have submitted a W-2 with incorrect data to the SSA.

An employer must provide one W-2C for each faulty W-2 filed with the SSA. The form copies must be handed over to both the SSA and employees.

Deadlines: Employers may file correction statements for up to two years preceding the ongoing tax year. But to avoid penalties, you should file W-2Cs before February 1, which is the deadline for W-2 forms.

Penalties: Filing corrections within 30 days past the deadline results in a $50 penalty. This increases to $110 if you file later. With further delays, the penalty may grow to up to $530.

What errors should you report in a W-2C?

Filling out a W-2C form is very straightforward. Most of the fields have counterparts

so that you can first specify the information reported incorrectly and then provide the corrected information.

But what types of errors should be reported? Here are the most common:

Incorrect employee name: To correct this, fill out the form up to box «i» and leave the numbered boxes blank.

Incorrect employee SSN: Fill in the fields up to box «i».

Incorrect dollar amounts: Complete all boxes if there was an error with the amounts for earnings and withdrawals.

Incorrect health coverage amounts: Medical insurance amounts covered by an employer must be corrected if mistakes were made in box 12 of a W-2 form.

Incorrect retirement contributions: You can report the correct information in box 13.

Do not use W-2C if you failed to include the employee name or SSN in a filed

W-2 form. To add the missing information, contact the SSA directly.

Fill out W-2C forms online with pdfFiller

Completing a W-2C form with pdfFiller only takes a couple of minutes and gets you several

copies of the document that can be printed out and distributed across your employees and local

governments. You can also use pdfFiller forms for your company’s internal records and communication.

Upload a W-2C form from the pdfFiller online library and convert it to a template.

Fill out the form by following the wizard’s tips.

You can also fill in forms collaboratively, leaving annotations for your colleagues. This will effectively eliminate errors.

Print out several copies of the form in one click.

Email digital copies to your employees.

Store your filled out forms in pdfFiller’s secure cloud and forget about lost files.

E-file tax forms online with pdfFiller

pdfFiller allows you to file forms W-2, 1099-MISC, and 941 online directly with the IRS. Just select the

newest editable PDF sample in our online library, fill it out in minutes, and click Send

to IRS. There’s no need to download or install anything! Besides, e-filing online

has many added benefits:

Ability to file forms from anywhere

Ensured accuracy

Submit your form to the IRS in a single click and email copies to your employees and independent contractors right from your pdfFiller account.

No added interest or penalties

Welcome to the pdfFiller forms catalog

Browse Versions and Schedules for All Relevant Forms

View related forms

Edit professional templates, download them in any text format or send via pdfFiller’s advanced sharing tools. See also Top Forms by user votes.

1099-MISC form

Miscellaneous Income

W2 form

Wage and Tax Statement is used to report wages paid to employees and the taxes withheld from them

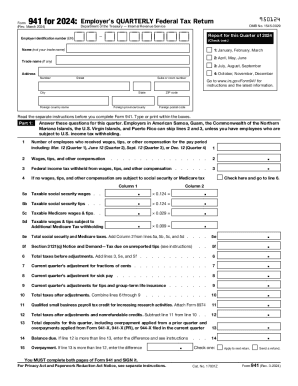

941 form

Don't use Form 941-V to make federal tax deposits. Use Form 941-V when making any payment with...

How to fill out other forms

Find the form you need, fill it out, and sign faster than ever before.

W-9 tax form

Request for Taxpayer Identification Number and Certification. For business owners and independent...

Read guide

W-4 tax form

Employee’s Withholding Certificate. Submitted to employers by employees

Read guide

1040-es tax form

Estimated Tax for Individuals. Helps self-employed with taxable income calculations

Read guide

1099-nec tax form

Wage and Tax Statement is used to report wages paid to employees

Read guide

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.