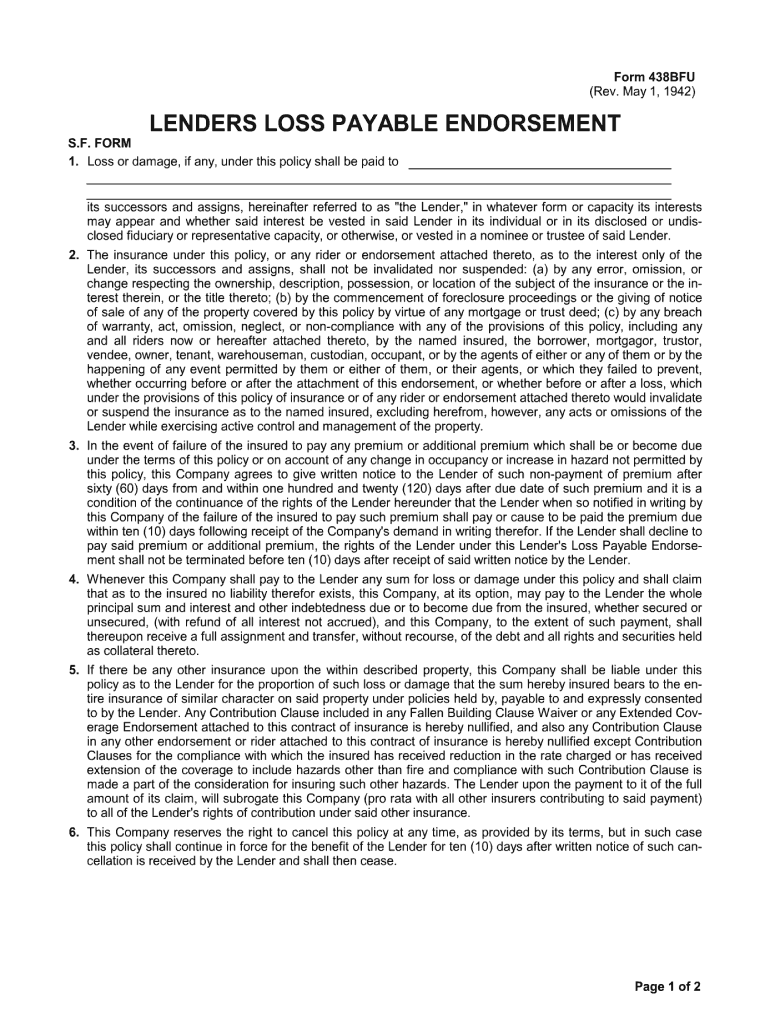

What is the purpose of the Form 438BFU?

As a rule, the borrower under a mortgage loan has to insure the property he is purchasing. For that purpose, the borrower enters into a contract of insurance with an insurance company. If something happens to the property while any amount of the mortgage loan is outstanding, the lender needs to have a guaranty that the mortgage will be paid. The Form 438FBU, otherwise known as the Lenders Loss Payable Endorsement, is an attachment to the property insurance policy that serves as the aforesaid guaranty.

Who needs the Form 438BFU?

The borrower, the lender and the insurer need this form.

Which documents do the Form 438BFU support?

The Form 438BFU is an attachment to the property insurance policy issued to the borrower under a mortgage loan.

When does the form expire?

The Form 438BFU remains in force and effect as to the interest of the lender for a period of ten days after expiration of the property insurance policy unless another insurance company issues an acceptable policy in renewal of the Form 438BFU, provided that the lender accepts the newly issued policy.

What information should be provided?

The first paragraph of the form should specify the lender.

In the last paragraph, the following should be specified:

- the lender’s address;

- number and date of the insurance policy; and

- the name of the insured.