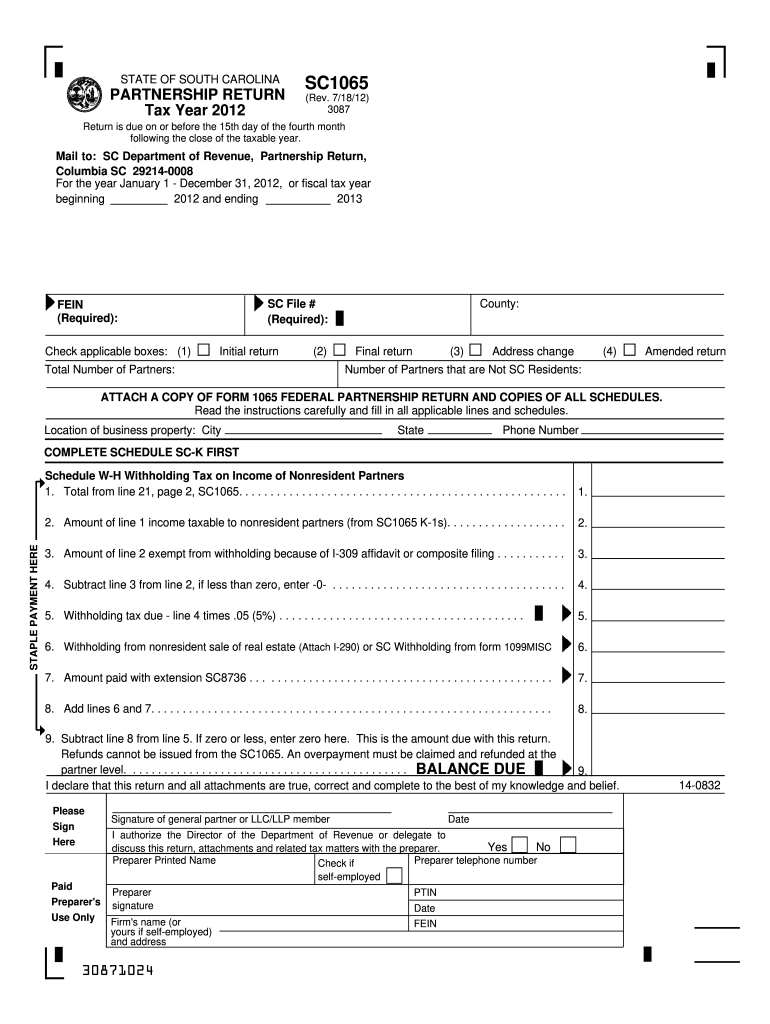

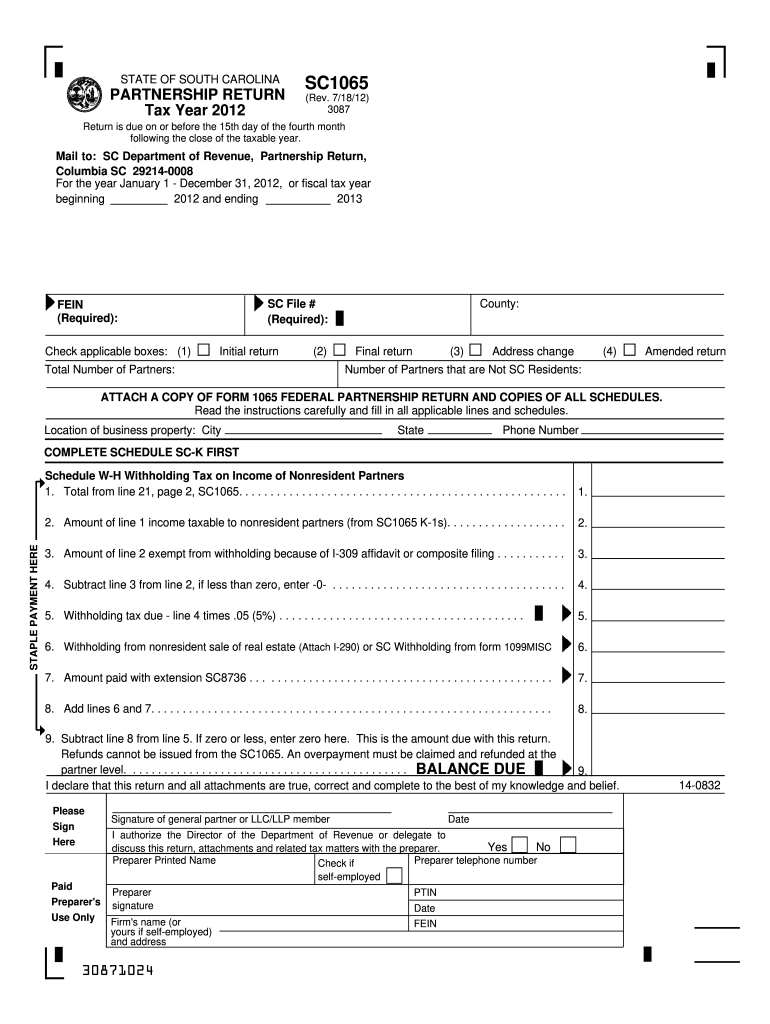

Get the free is there a fillable sc1065 form

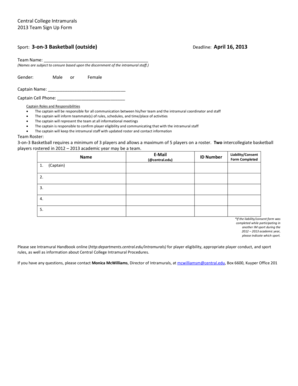

Get, Create, Make and Sign

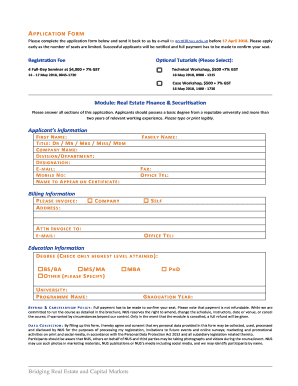

How to edit is there a fillable sc1065 form online

How to fill out is formre a sc1065

How to fill out is formre a sc1065:

Who needs is formre a sc1065:

Video instructions and help with filling out and completing is there a fillable sc1065 form

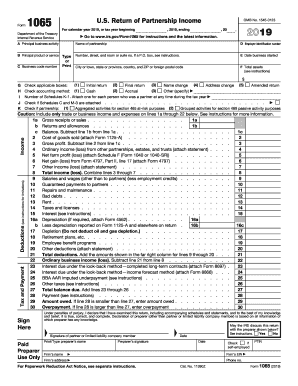

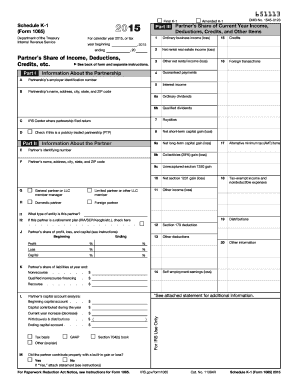

Instructions and Help about fillable sc sc1065 form

Hello everybody all right in this video I'm going to do something ridiculous because I actually enjoy doing my taxes this year I decided I'm going to do my taxes entirely by hand I'm actually going to fill out the 1040 tax return form it's completely free, and I did even though my taxes are pretty complicated I've got rental income dividends self-employment income and I wanted to walk you through it to show you how easy it is especially if your tax situation is even simpler than mine now if you're going to do this it's going to take about probably six to ten hours now for me yeah that's a lot but I kind of enjoy it on one hand, but also it really helps me get a good feel for what's going on with my money and understand how my tax code works in the country I live in, so I think it's useful educational and if you're crazy a little fun first let me show you what your tax return is your tax return is this simple two-page document form 1040 that you fill out, and you send in to the government to tell them how much income you made and how much tax you've already paid through withholding on your paychecks as you can see there's only 79 lines on this form and if your tax situation is really easy you might be able to fill out form 1040a or 1040ez which is even smaller but let's go with the worst case so let's just summarize exactly what this form looks like first is a section that's just your information you and your spouse if you're married filing jointly a name address social security number etc the next section is called exemptions you get one exemption for yourself your spouse and any dependents you have those exemptions simply reduce your taxable income they effectively make it, so you owe tax on less of your money finally there's a section for your actual income you make let's take a hypothetical guy who makes 50000 a year he's going to put that in this section now he also has a savings account and there are twenty dollars in interest over the year that is also taxable income and there's a line for that in this section if he has nothing else interesting going on he'll move on to the next oh it will list his total gross income at the bottom in this section then we move on to the adjusted gross income which takes into account some above the line deductions don't worry about what that means, but basically you subtract from your gross income some things such as a deduction for student loan interest, but our hypothetical guy might not have any of that, so his adjusted gross income is still fifty thousand and twenty just like his total gross income now we get to page two this lists out a lot of stuff in one little section, but you take other deductions you figure out what your taxable income is and figure out any credits, so our guy is just a single guy, and he's going to take the standard deduction everybody has the option to take a six thousand three hundred dollar deduction of their total income to get their taxable income, but that's not all you also...

Fill form : Try Risk Free

People Also Ask about is there a fillable sc1065 form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your is formre a sc1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.