Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Form 1065 is a tax form used by partnerships and limited liability companies (LLCs) to report their annual income, deductions, and losses to the Internal Revenue Service (IRS). This form is also known as the U.S. Return of Partnership Income and is filed by partnerships that have two or more partners or LLCs classified as partnerships for tax purposes. The form provides information about the partnership's profits, losses, and credits, which are then allocated to each partner according to their ownership percentage.

Who is required to file form 1065?

A Form 1065, also known as the U.S. Return of Partnership Income, is required to be filed by partnerships. A partnership is a business entity where two or more individuals join together to carry out a trade or business. Partnerships are required to file Form 1065 to report their income, deductions, gains, losses, and other related information.

How to fill out form 1065?

Form 1065, also known as the U.S. Return of Partnership Income, is used by partnerships to report their income, deductions, and losses to the Internal Revenue Service (IRS). Here are the steps to fill out form 1065:

1. Obtain the necessary forms and instructions: You can download form 1065 and instructions from the IRS website or visit a local IRS office to request hard copies.

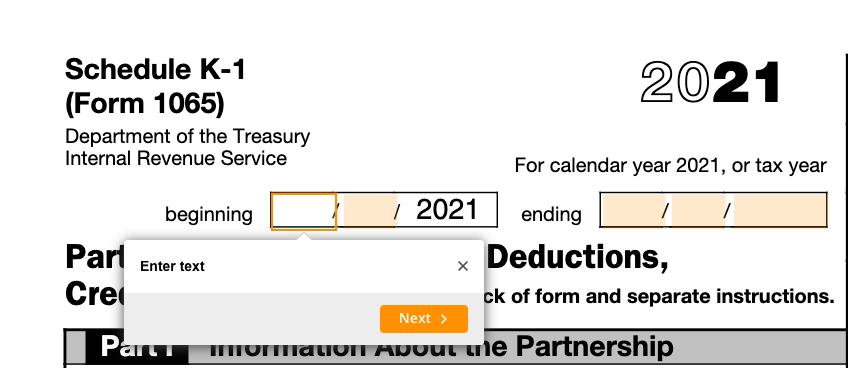

2. Provide partnership information: Fill out the basic information at the top of the form, such as the partnership's name, address, Employer Identification Number (EIN), type of partnership, and accounting period.

3. Complete Schedule B-1: Schedule B-1 is used to provide information about the partnership's income and deductions. Report taxable and non-taxable income, deductions, expenses, cost of goods sold, and other relevant financial information.

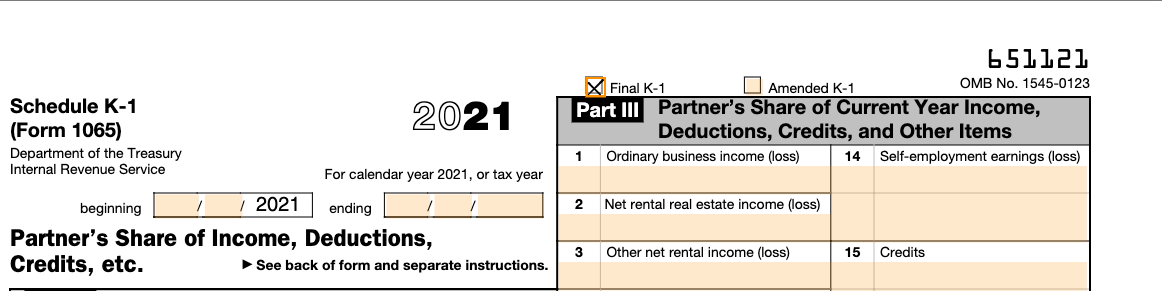

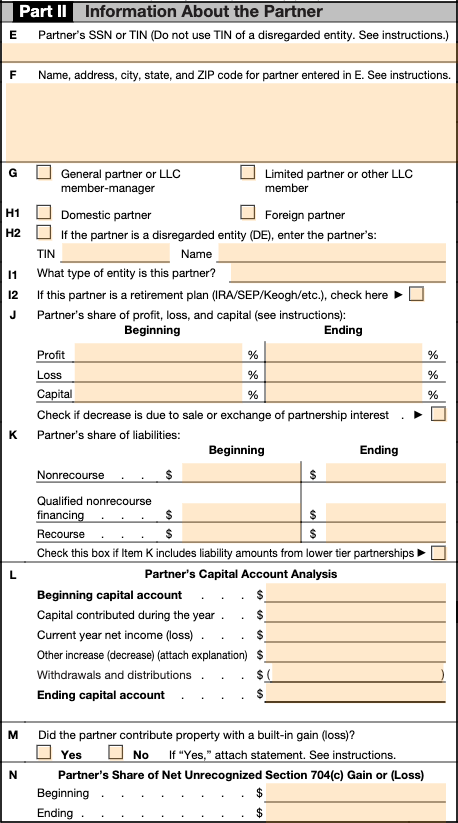

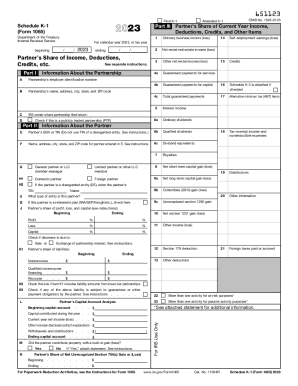

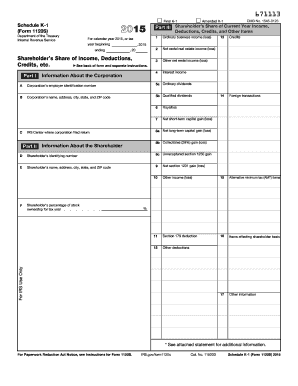

4. Include Schedule K: Schedule K is divided into several sections and is used to report each partner's share of income, deductions, and credits. Each partner's name, address, and Social Security Number (SSN) must be included.

5. Fill out Schedule L: Schedule L is used to report the balance sheet of the partnership, including assets, liabilities, and equity.

6. Attach Schedule M-1 and M-2 if applicable: Schedule M-1 reconciles the partnership's accounting income with its taxable income, while Schedule M-2 provides information about the partner's capital accounts.

7. Complete other applicable schedules: Depending on the nature of the partnership's activities, certain schedules may need to be filled out. These include Schedule D for capital gains and losses, Schedule E for supplemental income and loss, and Schedule K-1 for each partner's individual tax information.

8. Provide signatures and filing information: At the bottom of the form, the partnership representative must sign and date the return. Include the name, title, phone number, and date of signature.

9. Keep a copy for your records: Make copies of the completed form and all supporting documents for your records before submitting it to the IRS.

10. File the form: Mail the completed form and any applicable schedules to the appropriate IRS address based on your location.

It is important to note that the instructions for filling out form 1065 can be complex, and partnerships with more complex financial situations may require professional assistance from a tax advisor or accountant.

What is the purpose of form 1065?

The purpose of Form 1065 is to report the financial information and allocate the income, deductions, and credits earned or incurred by a partnership or a multiple-member LLC (Limited Liability Company) to the Internal Revenue Service (IRS). This form is used by partnerships to provide a detailed breakdown of the partnership's income, expenses, and deductions, as well as to calculate the amount of tax liability owed by the partnership. Additionally, Form 1065 also helps determine the distributive share of income or loss for each partner or member, which is then reported on their individual tax returns.

What information must be reported on form 1065?

Form 1065, also known as U.S. Return of Partnership Income, is used to report the income, deductions, gains, losses, and other relevant information of a partnership. Here are some of the key information that must be reported on Form 1065:

1. Partnership Information: The name, address, Employer Identification Number (EIN), and type of partnership (general, limited, etc.) must be provided.

2. Principal Business Activity: A description of the partnership's principal business activity must be mentioned.

3. Income: The partnership's total income, including gross receipts, sales, returns, allowances, and other income sources, must be reported.

4. Deductions: All allowable deductions, including business expenses, depreciation, depletion, salaries, interest, taxes, and other relevant expenses of the partnership, should be reported.

5. Partner Information: The names, addresses, and taxpayer identification numbers (TIN) of each partner must be provided. Additionally, their share of profit or loss, capital investment, and any changes in their ownership during the tax year should be reported.

6. Schedules: Various schedules may be required to provide additional information, such as Schedule K-1 (Partner's Share of Income, Deductions, Credits, etc.) and Schedule B (Other Information).

7. Tax Payments: Any estimated tax payments made by the partnership throughout the year should be reported.

8. Tax Elections: The partnership may need to report certain tax elections or other required information on the form.

It is important to note that this is not an exhaustive list, and additional information and forms may be required depending on the specific circumstances of the partnership. It is advisable to consult the instructions for Form 1065 or seek professional tax advice to ensure compliance with all reporting requirements.

When is the deadline to file form 1065 in 2023?

The deadline to file Form 1065 for partnerships in 2023 is March 15th, 2024. However, if you file for a 6-month extension using Form 7004, the deadline would be extended to September 15th, 2024. It is important to note that these dates may change, so it is always advisable to check with the IRS for any updates or changes in the filing deadlines.

What is the penalty for the late filing of form 1065?

The penalty for filing Form 1065, which is used to report partnership income, late is $205 for each month or part of a month the return is late multiplied by the total number of partners in the partnership. The maximum penalty is generally limited to 12 months. If the partnership is over 60 days late in filing, the minimum penalty is the lesser of $205 per partner or the partnership’s total income tax liability for the tax year divided by 6.

How can I manage my form 1065 2015 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your form 1065 2015 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send form 1065 2015 to be eSigned by others?

When you're ready to share your form 1065 2015, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I fill out form 1065 2015 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your form 1065 2015. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.